Updated January 22, 2024

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

After 512 long trading days, the S&P 500 closed at an all-time high last Friday. It was the fifth-longest gap between all-time highs in the last 60 years. The large-cap index rose 1.2% powered higher by the familiar mega-cap names. Chip stocks, headlined by NVIDIA (NVDA) at home and Taiwan Semiconductor (TSM) abroad, soared amid renewed AI euphoria. The Nasdaq Composite jumped 2.3% to finish at a fresh 2-year high. Outside of today’s glamor stocks, performance was actually quite lackluster. Six of the 11 S&P 500 sectors ended in negative territory, with Energy & Utilities being the biggest drags. In a week littered with Q4 earnings reports from large and small banks, the Financials sector rose 0.9%, almost keeping pace with the SPX.

Elsewhere, interest rates were on the rise for much of the week as economic data verified generally better than expectations. The 10-year Treasury yield rose just shy of 20 basis points, making tech’s advance all the more impressive. TIPS suffered a more than 0.7% loss while the rate-sensitive Real Estate sector ETF declined 2.1%. On the commodities front, crude oil continues to trade without much fanfare or volatility despite ongoing geopolitical tensions and drama in the Red Sea. Growth jitters in China and strong US energy production continue to pressure oil’s supply/demand balance to the bearish side. Gold fell more than 1%, and we can probably pin that move on higher real interest rates during the week.

For the year, the S&P 500 is up 1.5% and the Nasdaq Composite is higher by 2.0%.

January 12, 2024 - January 19, 2024

The Look Ahead

I mentioned that last week’s economic reports were mainly sanguine. We’ll see if the trend holds up with a slew of key data points to be released throughout the latter half of the week. Indeed, we must wait until Wednesday for the first market-moving release – a January read on S&P Global US Manufacturing and Services PMIs comes after the open. Economists expect another downbeat set of ‘soft’ data as the Manufacturing survey is expected to print a ninth consecutive sub-50 reading. The Services slice of the economy is generally faring better. Initial Jobless Claims dropped to nearly the lowest level since the 1960s last week, so forecasters will soon have a better sense if that was an aberration or a true sign of a tight labor market this Thursday morning.

Also hitting the tape at 8:30 a.m. ET Thursday is the preliminary fourth-quarter GDP report. The Wall Street consensus calls for a near-term +1.9% real rate of expansion, which would be a rather steep drop from Q3’s monster +4.9% growth pace. Q4 PCE inflation data also comes with that report, but traders might be more focused on December PCE figures that are released Friday morning. Durable Goods, a key leading economic indicator, should not be overlooked in the premarket on Thursday – economists forecast slower growth in the headline number and in the Ex-Transportation print while Shipments are seen as improving. There is also more housing market data, including New Homes Sales on Thursday and Pending Home Sales on Friday.

On the Central Bank watch, the Bank of Japan, European Central Bank, and the Bank of Canada all hold policy meetings while the US Fed will be in its blackout period ahead of its January 30-31 meeting.

Q4 GDP, December Durable Goods, and PCE Inflation Data Are the Headliners

Source: BofA Global Research

Earnings Reports This Week

Earnings season presses on this week with 75 S&P 500 companies reporting, including 10 Dow components. The EPS beat rate is weak thus far at just 62%. Moreover, the blended earnings growth rate is a concerning –1.7% after flipping positive in Q3. If there’s a profit dip for the previous quarter, it would mark the fourth time in the past five quarters that the index has reported a year-over-year earnings decline. So, this is a big week for firms across sectors to right the profitability ship.

Monday is rather quiet, but stalwarts such as Johnson & Johnson (JNJ), Proctor & Gamble (PG), and Verizon (VZ) report Tuesday morning while Tech-related companies report after the bell, including Netflix (NFLX) and Texas Instruments (TXN). ASML (ASML) offers more clues on the booming chip market Wednesday before the open and drama will build before Tesla’s (TSLA) numbers Wednesday night. Thursday is the busiest reporting day - Visa (V) serves up consumer insights and Intel (INTC) gives another glimpse at the semiconductor industry. American Express (AXP) is the headliner on Friday.

Earnings Season Broadens Out: Many Blue-Chip Companies Post Profit Numbers

Source: Wall Street Horizon

Topic of the Week: AI Takes a Victory Lap, Consumers See a Smoother Road Ahead

Bust out the playbook from the first seven months of 2023. Chip stocks left virtually everything else in the dust last week. It had macro implications, too. A pair of semiconductor companies, TSM and Super Micro Computer (SMCI), issued very healthy earnings updates. The former issued solid Q4 2023 quarterly results and voiced optimism about the near-term industry outlook while the latter posted preliminary earnings guidance that was leaps and bounds above what the analyst community was looking for. The result was a momentum thrust in what had already been a market hot spot to begin 2024. Friday culminated with shares of NVDA rocketing higher by 4%, furthering its technical breakout. AMD (AMD) and Broadcom (AVGO) likewise melted up to lift the SPX to a new high.

Also akin to the January through July stretch last year is that the ‘average stock’ was not invited to the party. The S&P 500 Equal Weight Index ETF (RSP) was lower during the holiday-shortened week. RSP remains in the red for the year, largely due to its sector allocation that favors more economically sensitive cyclicals and defensive stocks rather than the S&P 500’s significant tilt toward tech and growth. Moreover, a stronger dollar thus far in 2024 has weighed on foreign equities, which comprise about 37% of the global stock market. Pick your favorite ex-US fund, and it’s likely 2% to 3% down on the year. Finally, US small and mid-caps are far from their respective all-time highs, too.

Stronger Growth Care of Tech & AI?

The AI victory lap comes as the S&P 500 remains ahead of the pack. It has been a tough slog for diversified portfolios, and history shows such stretches of one theme outperforming the rest can test investors’ mettle. AI euphoria appears to be making its way into macro growth trends; last week, the Atlanta Fed’s GDPnow tool, a modeled forecast of the previous quarter’s US real GDP growth rate, increased to 2.4% after touching 2% earlier this year. We’ll get the official read on last quarter’s economic expansion rate this week, but the reality may just be that AI is fueling growth (normally, a stronger economy leads to higher real interest rates which can pressure tech valuations).

US Real GDP Growth Prospects Turn More Positive (Q4 2023)

Source: Atlanta Federal Reserve

Consumers May Finally Be Coming Around

Economists forecast weaker, though still positive, expansion this quarter and in Q2, but recession calls appear fewer and further between. That upbeat outlook is a stark contrast to a year ago. The vibes have improved at the consumer level, as well. Last Friday’s University of Michigan Survey of Consumers revealed the strongest sentiment reading since July 2021 – a period when “revenge spending” was all the rage as the economy bounced back from the pandemic.

The 78.8 survey reading was sharply above the consensus forecast of 70. Folks felt better about the inflation situation, evidenced by a three-year low in year-ahead inflation expectations (2.9%) and a tame view of where consumer prices may head over the next five years. Was the Michigan Wolverines winning the College Football Playoff National Championship two weeks ago and the Detroit Lions’ recent playoff success part of the strong “UMich” survey? Hard to say, but all things Michigan just seem to be working.

Consumer Sentiment Back to 2021 Levels, Biggest Monthly Climb Since 2005

Source: Trading Economics

Lowered Rate Cuts Chances, Inflation Still Top of Mind

Back to the real macro, this AI-driven expansion and inflation that continues to work in the Fed’s favor has reduced the chance of a March rate hike. Odds are now about 50/50 for the first ease in the cycle coming then, but Chair Powell and the rest of the FOMC may be hesitant to give in. Last week, we detailed how the inflation battle is not yet over, and that lingering unsolved inflation mysteries could keep the pace of consumer price increases higher than the Fed’s comfort level.

Macro analysts and portfolio managers can look to both ‘inflation swaps,’ a trading market for future inflation rates, and breakevens, using TIPS yields, for a sense of what the future could hold. These forward-looking indicators point to higher inflation rates over the coming year relative to what was seen in December. Traders remain fixated on near-term inflation trends for clues on what the Fed might do next, however.

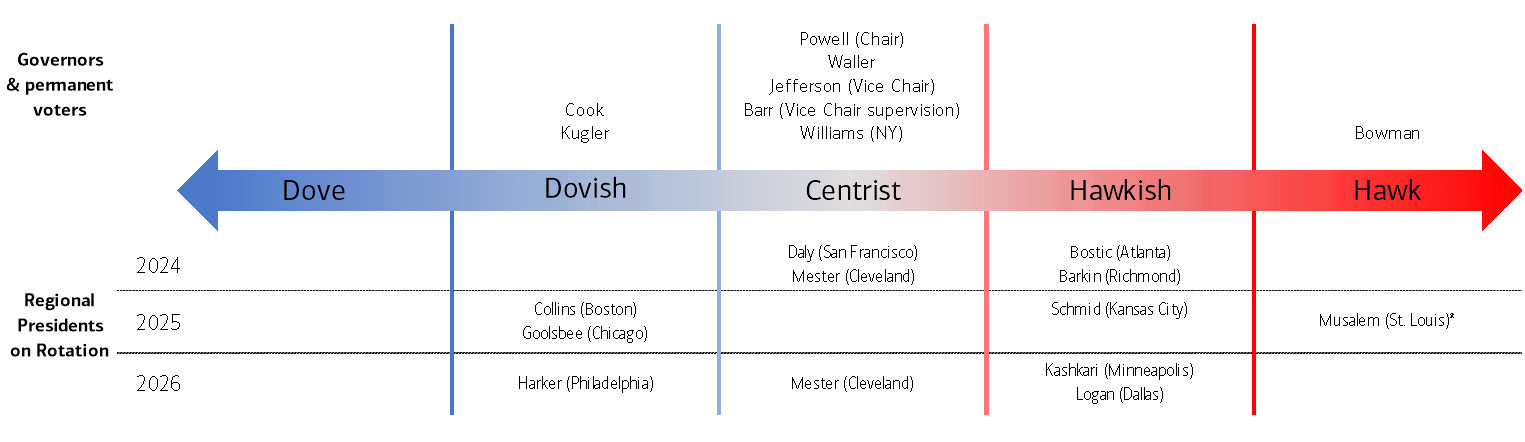

Cautious Fed Comments

There was important Fed Speak last week on that topic. Chicago Federal Reserve President Austan Goolsbee voiced optimism on where inflation was headed, but warned market participants that the first rate cut remains a meeting-by-meeting topic. Goolsbee, a former member of the Obama Administration is a well-known dove. Federal Reserve Governor Christopher Waller, a centrist on the Committee, delivered a speech in Washington, D.C. acknowledging that cuts are likely this year, but the FOMC can be patient with relaxing monetary policy.

The Fed’s Doves, Centrists, and Hawks

Source: BofA Global Research

Credit Card Companies in Focus This Week

In net, stronger growth trends, better consumer vibes, and Fed Speak to the hawkish side were the primary culprits of rising interest rates last week. Also on the growth front, December Retail Sales proved stronger than forecasts. It confirmed that the tail-end of the holiday shopping season was indeed solid, and that data was backed up by comments made by the CEO of American Express on Friday. In an interview with CNBC, Stephen Squeri said the credit card company saw “good consumer spending” trends at the end of 2023 while delinquencies are down from 2019. The full scoop on AXP’s fourth quarter results comes this Friday. Of course, comments from CEOs almost always paint a bright picture.

Last week, shares of Discover Financial Services (DFS) tumbled following a steep earnings miss and an increase to its credit loss provision, suggesting all is not so well among consumers on the lower end of the income scale. That makes Thursday’s quarterly results from Capital One Financial (COF) and Visa (V) even more important.

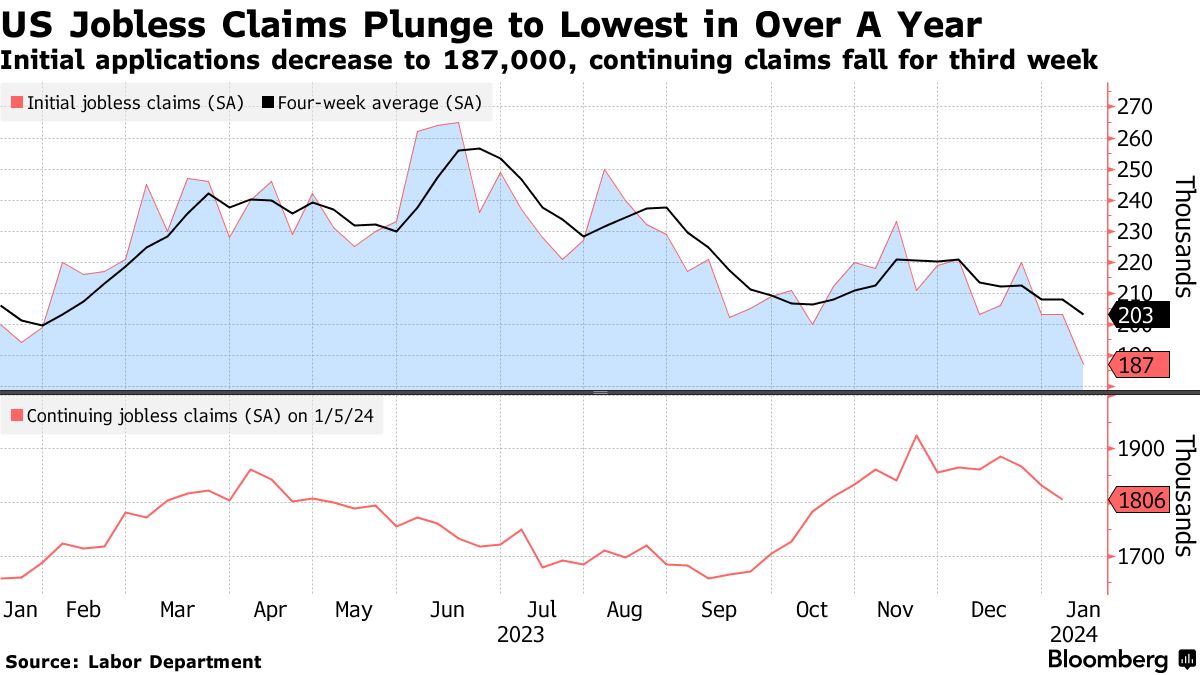

Super Low Jobless Claims and Corporate Layoff Announcements: What Gives?

Parsing credit card issuer profit reports is helpful, but it might all come down to the jobs situation as to how consumer spending trends unfold. Last week’s data-point stunner might have been the weekly Initial Jobless Claims number. At just 187k, it was the lightest number since September of 2022 and basically near all-time lows since the 1960s. It’s possible that seasonal tweaks played a role, so economists will pay particular attention to how this Thursday’s claims report verifies, though Initial Claims’ four-week moving is near 1-year lows. It comes as companies such as Alphabet, Amazon, Citigroup, and Blackrock have all warned of layoffs.

Initial Jobless Claims Drop Despite Headlines of Corporate Labor Cutbacks

Source: Bloomberg

The Bottom Line

The growth trade is back on to jumpstart 2024. AI-related tech stocks have soared, pushing the Nasdaq Composite to its highest mark since January 2022 and the S&P 500 to all-time highs. Amid ebbing, though not dead, inflation risks, consumers reportedly feel more hopeful about what lies ahead. Both micro and macro data flood this week through a bevy of earnings reports from companies across sectors and via a handful of economic reports from Wednesday through Friday.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!