Updated January 29, 2024

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

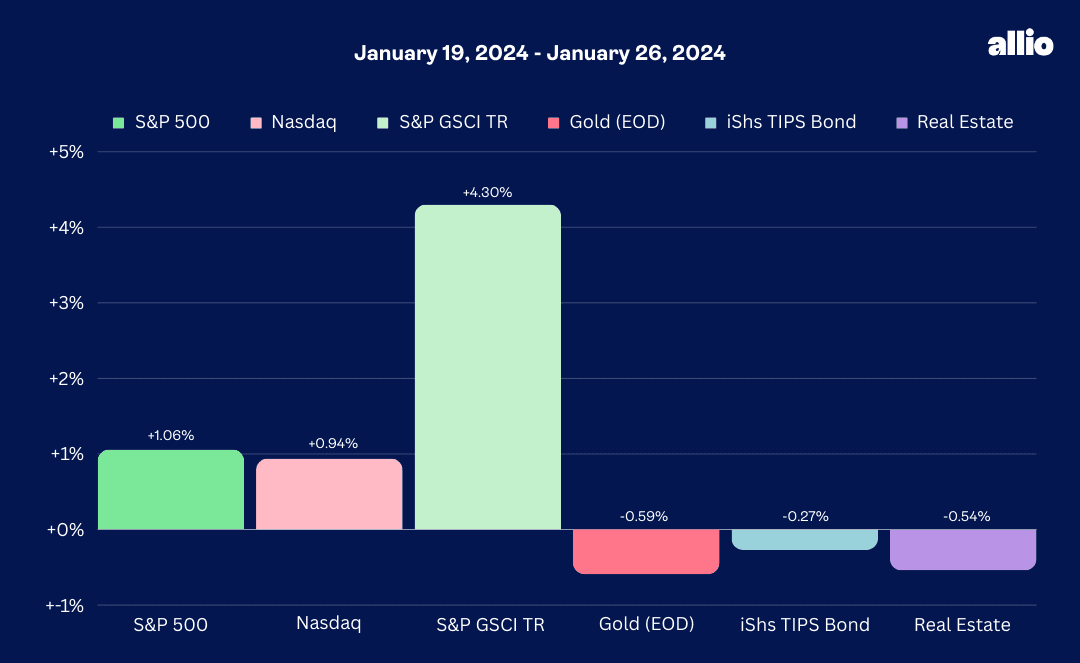

It was a rather quiet week across markets. The S&P 500 rose 1.1% to settle at yet another record high. The US large-cap index is now positive in 12 of the past 13 weeks. The Nasdaq Composite also finished in the green, rising slightly less than 1%, with the Communication Services sector rising 3.8%. That area wasn’t the strongest spot, however. The beleaguered Energy sector was the big winner last week, soaring more than 5% for its best one-week rally since March last year. Financials, another key part of the cyclical style, have also performed well – bookmark that observation for now. Oil prices jumped to fresh highs dating back to November 2023. Overall, the commodity complex is up 9% from its low last month, and rising costs for raw materials will be a key macro factor to monitor over the coming weeks.

Elsewhere, bond yields rose once again. The yield on the benchmark 10-year Treasury note increased to 4.16% as economic optimism only grew following sanguine inflation data released at the end of last week. That move pressured fixed income, including the TIPS market. Loftier interest rates also hurt the yield-sensitive Real Estate sector – XLRE was one of just three sectors to close lower during the last full week of January. Finally, gold continues to be lackluster, dropping modestly amid the climb in real interest rates and a generally steady US Dollar Index.

For the year, the S&P 500 is up 2.5% and the Nasdaq Composite is higher by 3.0%.

January 19, 2024 - January 26, 2024

The Look Ahead

It's a very busy week on the data front. Monday is quiet as traders prepare for a host of major macro and firm-specific headline drivers. Tuesday morning gets going with a November look at the Case-Shiller Home Price Index. Expected to show a 5.5% climb from year-ago levels, the real estate market has shown signs of recovery lately, though rent prices are in full-blown retreat mode, further widening the cost gap between owning a home and renting. Later that morning, the Conference Board’s January Consumer Confidence report hits the tape. More geared toward growth, economists will eye this sentiment gauge to see if it aligns with the inflation-driven University of Michigan Surveys of Consumers that unofficially ended the so-called “vibe-session” earlier this month.

The Job Openings and Labor Turnover Survey (JOLTS) for December opens the employment-data floodgates at 10:00 a.m. ET Tuesday, a report Chair Powell pays close attention to for clues on the supply/demand balance in the labor market. Then comes the ADP Employment survey which will shed light on January’s private sector payroll change – consensus sees a steady 150k gain. The Employment Cost Index could move the Treasury market if it comes in hot and the Chicago PMI data point may move equities shortly after the opening bell Wednesday.

The big event mid-week is the first FOMC Rate Decision of the year. While no change in the policy rate is expected, all eyes will be on the Fed statement to see if there are new emerging thoughts among Committee members regarding a March or May interest rate cut as well as what the plans are for tapering quantitative tightening. Chair Powell’s words during the afternoon press conference will also be highly scrutinized. Recall the market’s reaction to what was interpreted as a dovish pivot in last month’s statement and presser.

Thursday morning’s Initial Jobless Claims report is forecast to hold in the low 200,000s following last week’s jump from nearly the softest claims figure since the 1960s. At the same time, a first look at Nonfarm Productivity and Unit Labor costs will offer further color on the state of the jobs market – economists expect a significant rise which would result in a pullback in the sequential productivity percentage. A final update on January S&P Global US PMI should come with little fanfare, while the ISM Manufacturing report is expected to print under 50 yet again, which would be a 15th consecutive month of contraction (the longest stretch since 2000-2001).

Construction spending also hits at 10:00 a.m. ET on Thursday, and a steady rise is anticipated. On the manufacturing front, we will also get a slew of January vehicle sales from both US and global auto manufacturers. The big data point of the week is of course the Nonfarm Payrolls report for January. Forecasters predict a 185k employment gain, though just +148k for the private sector. The unemployment rate is expected to hold at 3.7% and average hourly earnings are seen rising at a 0.3% monthly clip. A final UMich update and Factory Orders round out the eventful week on the data front.

FOMC Meeting, Labor Market Data, ISM Manufacturing Are the Headliners

Source: BofA Global Research

Earnings Reports This Week

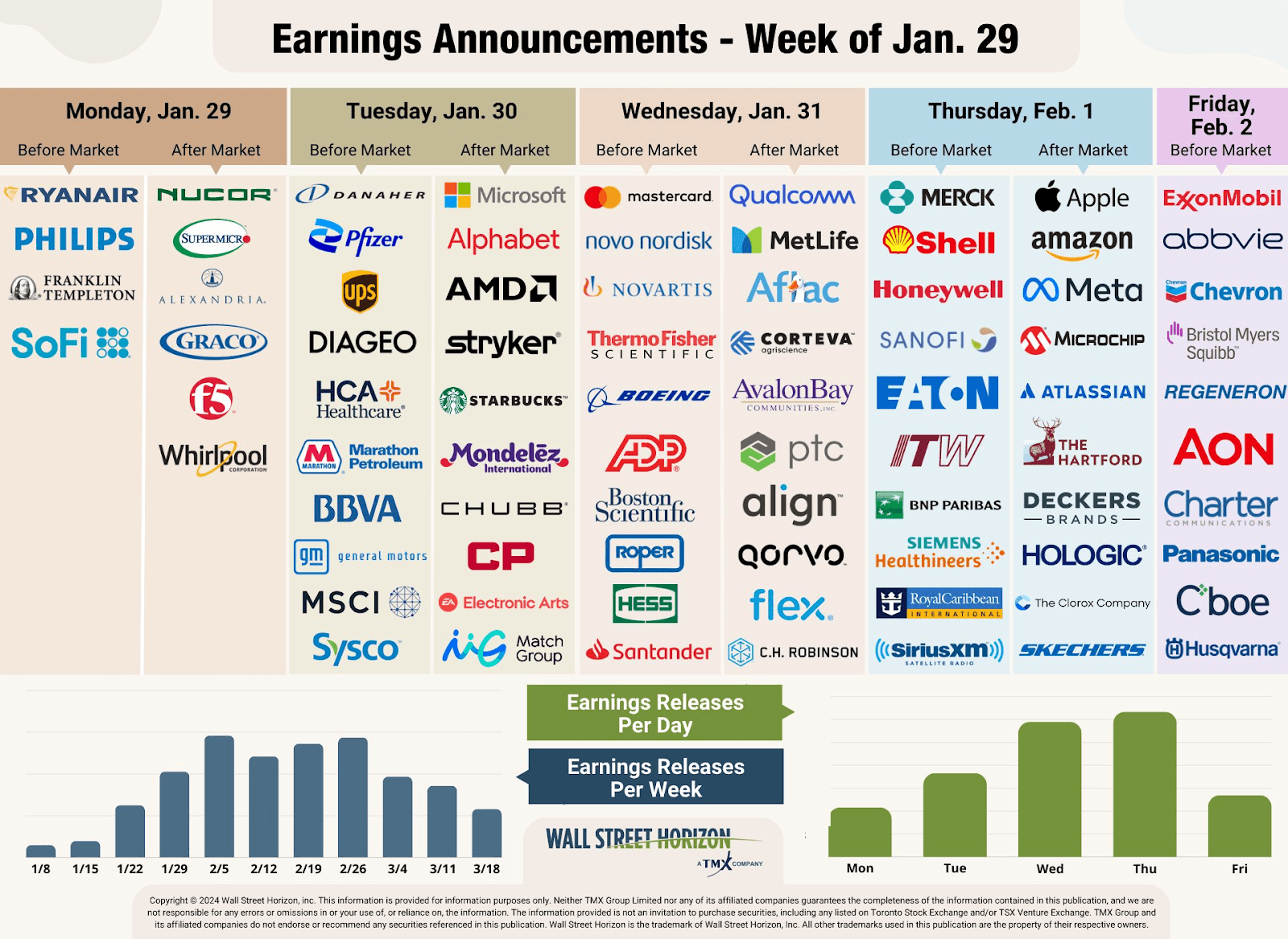

$10.5 trillion worth of market cap reports quarterly earnings this week. It's the most active stretch of the season, highlighted by five of the Magnificent Seven companies. Super Micro Computer (SMCI) will be one to watch Monday night following the chip name’s extremely bullish preannouncement earlier this month. Pfizer (PFE), UPS (UPS), and General Motors (GM) are the high-profile names Tuesday morning before Microsoft (MSFT), Alphabet (GOOG), AMD (AMD) and Starbucks (SBUX) light up the tape in the afternoon.

A bevy of major Healthcare companies issue results Wednesday morning, including GLP1-maker Novo Nordisk (NVO) while we’ll get another read on the consumer from Mastercard (MA). On Thursday, major global Industrials sector firms report before the bell. Then in the afternoon, Apple (AAPL), Amazon (AMZN), and Meta Platforms (META) provide their Q4 results. As usual, the two Energy sector heavyweights, ExxonMobil (XOM) and Chevron (CVX) cap off the week.

By Friday, we will have a good handle on where 2023’s final S&P 500 EPS number will likely verify as well as how Q1 2024 expectations appear. So far, the bottom-line beat rate is a tepid 69% and the blended EPS growth rate remains in the red at –1.4%.

Mega-Cap Tech Steps Up to the Earnings Plate

Source: Wall Street Horizon

Topic of the Week: Don’t Overlook the Overseas Markets

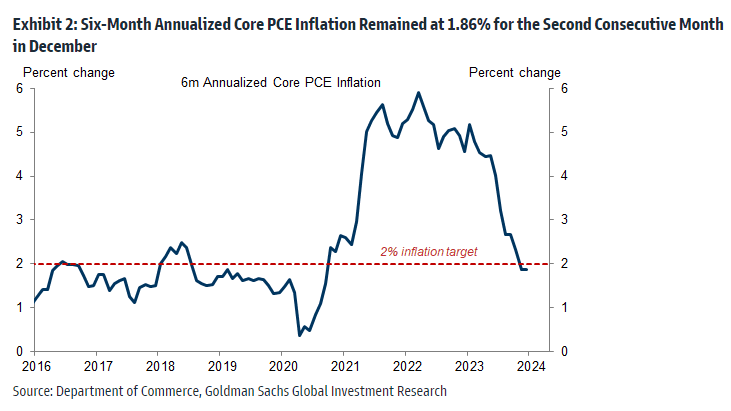

Everything just seems to be coming up roses for the US economy. Last week, Q4’s real GDP growth rate verified much better than expectations while both fourth quarter and December PCE inflation figures were near or under forecasts. The “Goldilocks” economy, soft-landing narrative, and immaculate disinflation, all, for now, point to a “golden path” (as the Fed’s Austan Goolsbee is wont to say. And with consumers feeling more upbeat about things, the data and vibes would appear to assert that sticking with what has worked is the way to go.

Core PCE Inflation Reaches the Fed’s Target

Source: Goldman Sachs

For portfolio managers, however, it’s at times like this when spotting strategies that are out of consensus can reap rewards later on. At home, the debate continues among strategists on whether to be overweight small caps or simply focus on the AI and mega-cap tech trades. Small caps command a narrow slice of the total market, though. We are talking about 3% in terms of their relative size. The foreign stock market, by contrast, is 36% of the global investable equity universe. Discarding it comes at a risk.

A Lost 16 Years, Inexpensive Stocks

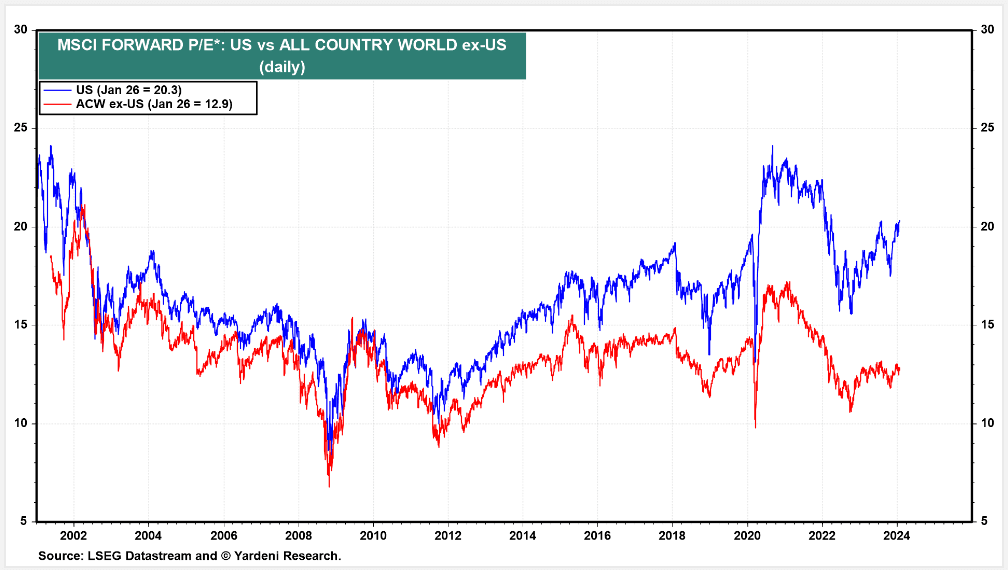

Of course, investors who have shunned overseas equities have done very well in the last decade. Consider that the S&P 500 has annualized 12.6% since the start of 2014 while ex-US stocks have compounded at a mere 4.4% in that time. Today, the S&P 500 trades at 20.3 times forward earnings estimates while the all-country ex-US index sells for a smidgen under 13 times. More than seven turns more expensive, the S&P 500 appears increasingly pricey on both a nominal and relative basis. Even accounting for sector differences, foreign shares look decent on valuation.

US Versus Ex-US Stock Market Valuations: The Gap is Widening

Source: Yardeni Research

It’s All About Your Time Horizon

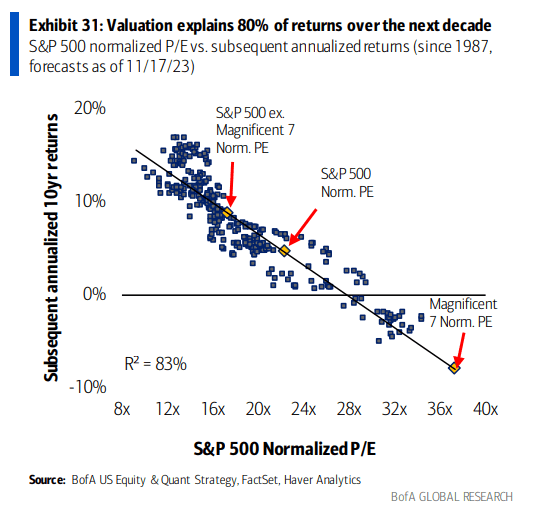

What’s more, the international markets are now a better bargain than even the underperforming domestic small caps which you can buy for about 15 times earnings. Now, some fund managers focused on P/E multiples will die on the hill of shunning the Magnificent Seven, clinging to deep-value companies. Valuation is indeed a tricky tool. Over one-year periods, the P/E ratio has little relevance. Stretch your time horizon out five years or a decade, though, and what you pay today certainly matters. BofA’s quant team points out that for the S&P 500, valuation explains a high 80% of returns over 10 years.

Explaining Returns: Valuation Matters, But Over the Long Haul

Source: BofA Global Research

Diversification Through Sectors

With that in mind, is now the time to rethink an allocation? Well, recall what I spoke about earlier in the Monitor. What sectors seem to be springing back to life? Energy and Financials. These are two classic “value” sectors. They are also a pair that are relative overweights in non-US markets compared to the SPX. If we see a rotation into economically sensitive stocks, then foreign shares may stand to benefit more than the growth-focused US large-cap index.

Keep Calm and Carry On

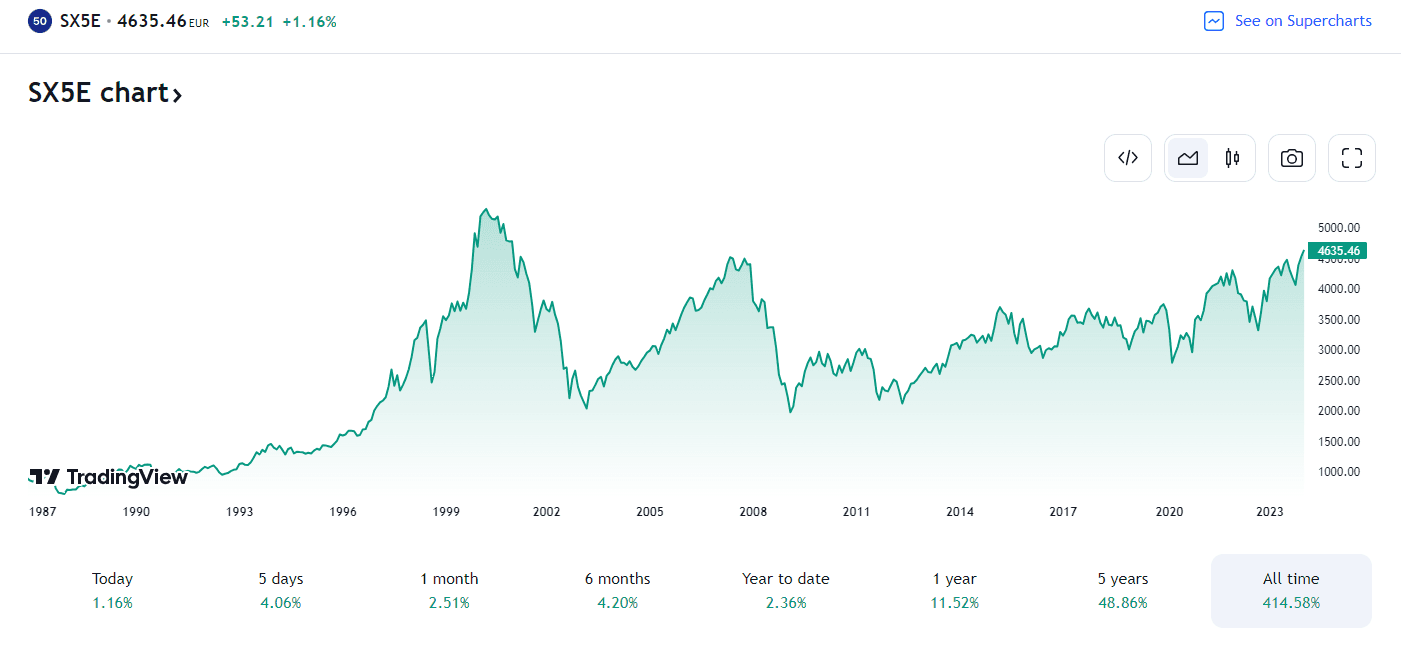

You don’t have to be an old-school, cigarette-butt value stockpicker when sifting through the global market. An emerging Magnificent Seven is being bantered about on social media. Shares of companies such as Denmark’s Novo Nordisk, Germany’s SAP, the Netherlands’ ASML, and LVMH in France have enjoyed très bon returns in the last several months. Performance has been so good since mid-October last year that the Euro Stoxx 50 index settled at a high dating back to 2007 on Friday.

Euro Stoxx 50 Index Rallies to Fresh Multi-Year Highs

Source: TradingView

Namaste: Strong Returns in the Far East

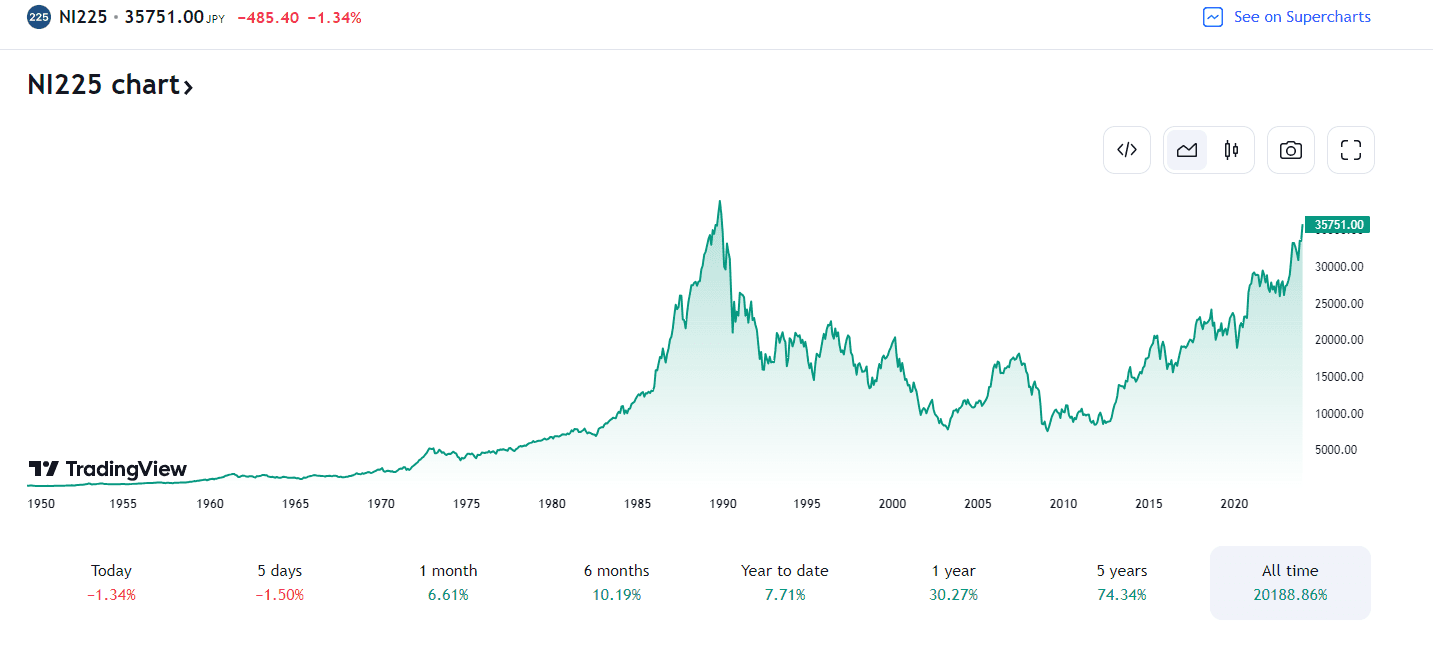

It’s not just a European thing, either. In Asia, Taiwan Semiconductor has powered higher by nearly 40% from its late-year trough, driven by the same tailwinds benefiting US AI and chip companies. Meanwhile, India sports some of the most bullish demographic trends, helping to keep the embattled Emerging Markets index afloat. Let’s not forget about ascending returns in the land of the rising sun, too. The Nikkei 225 index is closing in on all-time highs for the first time since 1989. Boring old Toyota Motor Corp has surged 56% in the last 12 months.

Japan’s Nikkei 225 Reaches 34-Year Highs

Source: TradingView

China Continues to Sink, Pessimism Reaches Extreme Levels

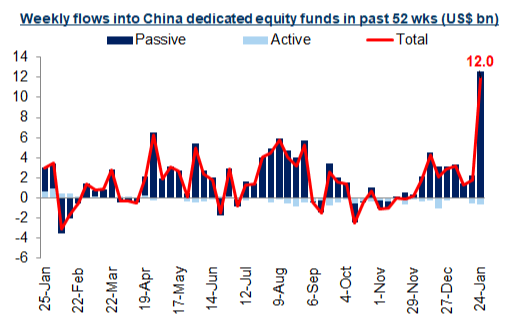

The biggest global drag has undoubtedly been China. Both the Shanghai Composite and the Hang Seng are mired in punishing bear markets. Just in the last three years, Chinese equities are down close to 60% amid draconian public lockdowns even after the worst of the pandemic and then authoritarian crackdowns across sectors by President Xi Jinping’s government. The only stock that seems to work in the world’s second-largest economy is PDD Holdings. Interestingly, amid such downbeat sentiment, China equity funds took in $12 billion last week – the second biggest sum in history.

Big Weekly China Inflow

Source: Goldman Sachs

Free Markets Embraced in South America?

Finally, maybe the most overlooked of all non-US arenas is Latin America. The region depends on strength in both the banks and resource-related industries. One of the best-performing country ETFs over the past three months is EWW which tracks Mexico stocks. Inspect that fund’s holdings, and you will find a handful of firms from the Financials sector.

As we hopscotch the globe Carmen-Sandiego style, our last spot is South America. Within this most politically unstable region, a capitalistic wave may be underway. Javier Milei, newly elected president of Argentina, rebuked the big-government elitist tone at Davos earlier this month. With free-market principles of high priority, the Argentina stock market has outperformed the S&P 500 in the last year (+32% versus +22%).

Allio Globetrotters

As macro portfolio managers, Allio is always on the hunt for value opportunities and momentum plays beyond our borders. While the international stock market has performed poorly for more than 16 years compared to the S&P 500, what may very well be emerging bull markets ex-US capture our eye today.

The Bottom Line

Here we are starting down the busiest week of US economic data and corporate earnings reports, and we are talking about investment themes overseas. We believe that having some exposure to foreign markets makes sense today, and if there is relative outperformance among global equities, a position away from domestic glamor stocks makes sense.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!