Updated March 25, 2024

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

Stocks enjoyed their best week of the year care of a dovish Fed meeting and solid economic data. The S&P 500 rose 2.3% to settle at yet another record high on a weekly closing basis. Despite a dip on Friday, the SPX has notched 20 daily record settles as the recovery that began last October powers ahead; there hasn’t even been a 2% dip over the past 100 trading days. We are also now four years removed from the bottom hit during the COVID-19 pandemic – the S&P 500 has returned 168% since then while the Nasdaq 100 has outperformed, up 148% with dividends included. Back to the here and now, tech-related stocks indeed led the way last week as the Nasdaq Composite jumped 2.9%.

Sector-wise, Communication Services posted the biggest gain, but the blue-chip Industrials sector also outperformed. Health Care continues to make relative lows to the SPX and the embattled Real Estate sector likewise underperformed even with a bid to the bond market. Small caps managed to post a material gain after the previous week’s decline, though a stronger US dollar put relative pressure on foreign equities – that group was about flat.

Yields indeed dropped during Fed week. Gentle comments from Chair Powell assuaged bond traders’ fears that the FOMC may wipe a hike off the forecast table. While there were healthy housing market reports and other decent economic data, the rate on the 10-year Treasury note fell about 9 basis points, lifting the aggregate fixed-income market and the TIPS ETF. Commodities were calm despite a mid-week rise in WTI and Brent oil – the former snuck a peek at $83 last Tuesday afternoon before finishing Friday under $81. Gold price soared to a record $2,222 per ounce post the Fed decision, but finished fractionally down for the week.

For the year, the S&P 500 is up 9.7% and the Nasdaq Composite is higher by 9.4%.

Source: Stockcharts.com

The Look Ahead

It’s a holiday-shortened week with the NYSE closed for Good Friday in advance of the Easter weekend and the finish to the first quarter. Monday morning features more February housing market data, this time it’s New Home Sales. With impressive Building Permits, Housing Starts, and Existing Home Sales numbers reported last week, along with a significant rise in homebuilder sentiment, the whisper New Home Sales number may be higher than the official street estimate. What’s more, homebuilder stocks, up 70% from a year ago, continue to be on a tear. It is becoming apparent that prospective buyers are settling in to the reality that 7% mortgage rates may be here to stay.

We’ll get more real estate data on Tuesday via the Case-Shiller Home Price Index, though it’s a January read, so don’t expect much impact when it’s released in the pre-market. What may move stocks and bonds is the Durable Goods report which comes out a half hour earlier. Following lackluster figures within the January final read, the February preliminary Durable Goods look is forecast to show a modest rise. Troubles with Boeing could once again distort the headline figure, though, so paying closer attention to the report’s internals will be important. Then, at 10:00 a.m. ET, The Conference Board’s Consumer Confidence report hits the tape. After a gangbuster January update, February’s confidence report sagged, but a small recovery is expected for March as the labor market remains healthy and wages continue to generally outpace inflation.

Wednesday is light on the data front, but the action picks back up on the final trading day of Q1. Thursday features Initial Jobless Claims – another non-noteworthy number is expected. At the same time, the third update to the Q4 GDP report crosses the wires which shouldn’t contain many surprises, but it’s always helpful to watch out for revisions to growth and inflation figures. Volatility could come about later that morning when Chicago PMI, UMich consumer sentiment, and February Pending Home Sales post.

The biggest data of the week comes out when markets are closed – February Personal Income & Spending along with PCE inflation hits on Good Friday, so non-futures traders will have to wait until April 1 to decipher that. Powell suggested that it could be a “bumpy path” on the road to 2% inflation, so even if we get warm inflation prints, perhaps markets will take that in stride. As it stands, year-on-year Headline PCE inflation is expected to tick up from 2.4% to 2.5% while the Core rate is seen holding steady at 2.8%.

Despite the holiday, Powell is slated to participate in a discussion panel at a monetary policy conference midday on Friday. Bostic and Waller also speak on Monday morning and Wednesday evening, respectively.

PCE Data in Focus, More Housing Market Data, Good Friday

Source: BofA Global Research

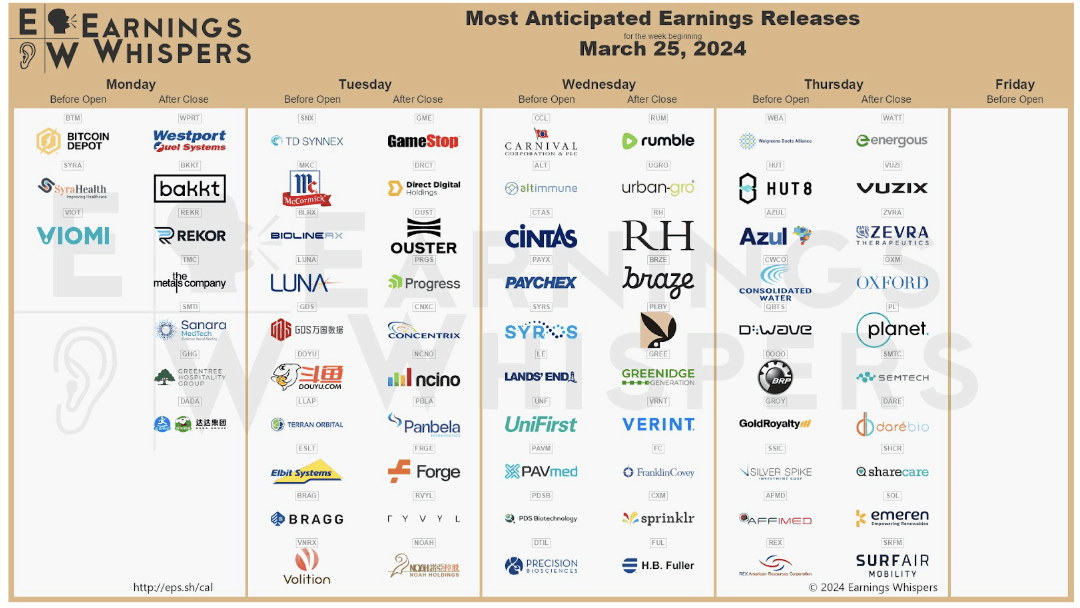

Earnings Reports This Week

While we normally reserve this section for quarterly reports, Monday will have political implications – Digital World Acquisition (DWAC) has high implied volatility following the approval of a merger with the new social media company owned by President Trump. The new company, Trump Media, will likely begin trading under the ticker “DJT” early this week, netting the 45th POTUS a major payday.

On Tuesday, Consumer Staples company McCormick (MKC) and GameStop (GME) of meme-stock mania fame report before BofA’s Global Auto Summit begins. UPS (UPS) holds its Analyst Day and a 3-day Summit hosted by Adobe (ADBE) with CEOs from General Motors (GM) and Delta Air Lines (DAL).

Earnings from Carnival (CCL), Cintas (CTAS), Paychex (PAYX), and capital markets company Jefferies (JEF) come on Wednesday with key events potentially drawing volatility in shares of Moderna (MRNA), Walmart (WMT), and Rivian (RVN). The brief week wraps up with Q4 results from former Dow component Walgreens Boots Alliance (WBA).

GameStop, Carnival, Cintas, RH, Walgreens Highlight a Light Reporting Week

Source: Earnings Whispers

Topic of the Week: Some Inflation is OK

Painful Powell has morphed into Jolly Jay. As the Fed began its rate-hiking campaign two years ago, the Chairman seemed hell-bent on clamping down on inflation. After CPI surged to a four-decade high in June 2022, supply chain disruptions began to ease, and energy prices fell following Putin’s invasion of Ukraine. But wage growth was still much too high as labor hoarding persisted in the corporate world. Markets were then dealt blow after blow in the form of large 75-basis-point rate increases every six weeks in Q2 and Q3 that year. Fed Speak was notably hawkish throughout 2022 and 2023 – jawboning has become a de facto part of monetary policy for the vocal central bank.

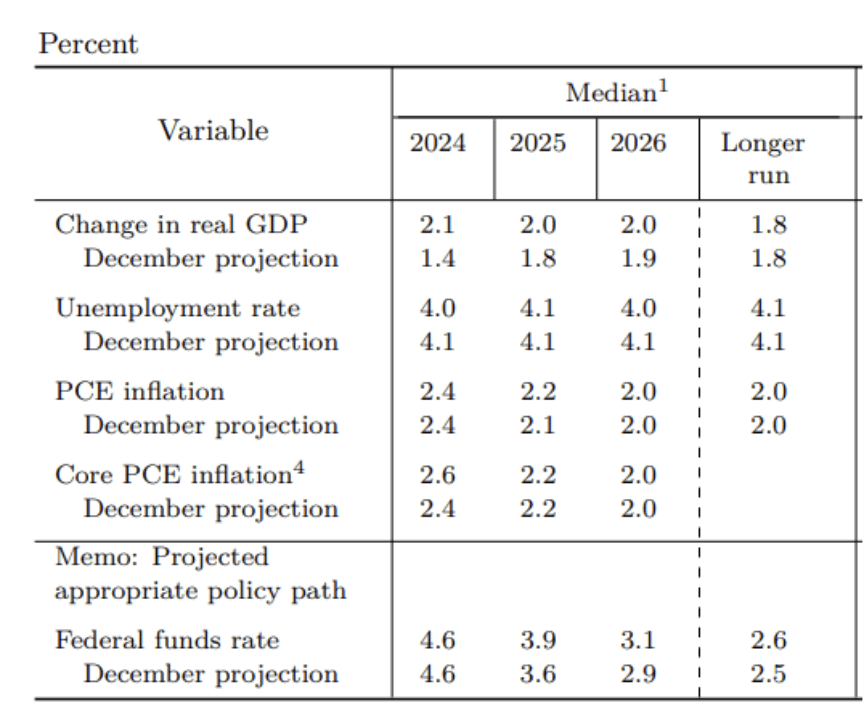

Jump ahead to today, though, and Powell appears to be a happy guy. He voiced cautious optimism about the path of inflation and the state of the economy in the FOMC press conference last Wednesday – he even cracked a joke about stock prices. No interest rate change was expected, but traders were on edge ahead of the 2 p.m. statement and quarterly dot plot guidance, fearing that voting members may strike a rate cut off the 2024 table. That didn’t happen. Despite forecasting higher GDP growth and even slightly more elevated inflation, the FOMC kept three quarter-point eases in play through year-end. Then, during the presser, while Jay did not provide a precise date for the initial cut, he reiterated that he expects lower rates later this year, so long as the data cooperate.

The Fed increased its GDP outlook for this year from 1.4% to 2.1% with the unemployment rate now expected to verify at 4%. Core inflation is forecast to come in at 2.6% in 2024 and to arrive at the central bank’s 2% target by 2026. Also notable, the Fed raised its long-term neutral rate forecast – the rate that neither causes an uptick in unemployment nor results in inflation that’s too high – from 2.5% to 2.6%.

Federal Reserve Summary of Economic Projections (SEP)

Source: Federal Reserve

Stocks and Bonds Rejoice Post-Fed

Markets responded kindly to the accommodative SEP and press conference. The S&P 500 rallied just shy of 1% with particular strength among US small caps and regional banks – areas sensitive to changes in borrowing costs. The party lived on through Thursday with more all-time highs hit across global markets before profit-taking transpired to close out the week. Bonds, meanwhile, firmed up with the yields on the decline and corporate credit spreads remaining at or near cycle tights. Commodities didn’t move a ton on the Fed news, but the US Dollar Index spiked more than 1% for its best week since the start of the year.

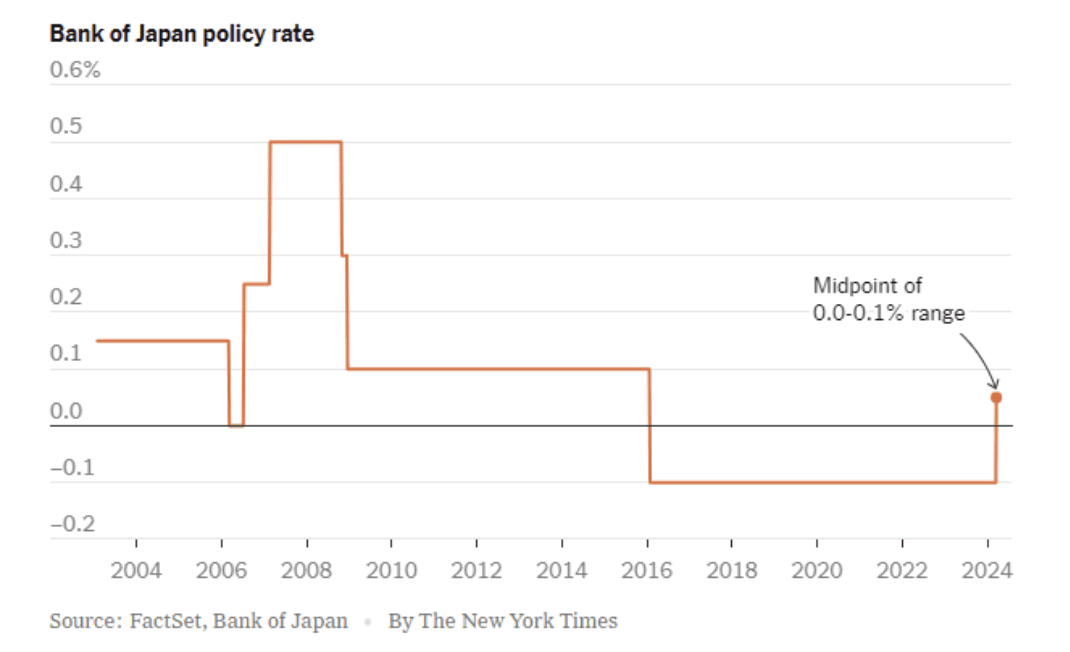

Japan Jumps Its Rate

The Fed wasn’t the only policy action making news last week. The Bank of Japan, at long last, lifted its policy rate for the first time in 17 years, ending its historic run of negative interest rates. It comes as wages in the world’s fourth-largest economy were negotiated higher by the biggest amount in three decades and as corporations are encouraged to engage in more shareholder-friendly activities. It’s a bullish backdrop for the land of the rising sun, and the Nikkei 225 Index settled last week at a fresh all-time high just under 41,000.

Japan Hikes for the First Time Since 2007, Better Inflation and Rising Wages Draw BoJ Action

Source: New York Times

Better Times for Home Buyers

Back home, hope emerges that a growth rebound may be underway. As mentioned earlier, housing market data came in strong as the spring home-buying season kicked off. The prevailing rate on 30-year mortgages remains near 7%, but its spread over the 10-year Treasury yield has compressed from above 320 basis points in 2022 and 2023 to just 260 basis points. While the long-term average is closer to 1.9 percentage points, it’s a hopeful sign for would-be first-time home buyers.

Mortgage Rate-Treasury Rate Spreads Drops, A Tailwind for New Home Buyers

Source: Yardeni Research

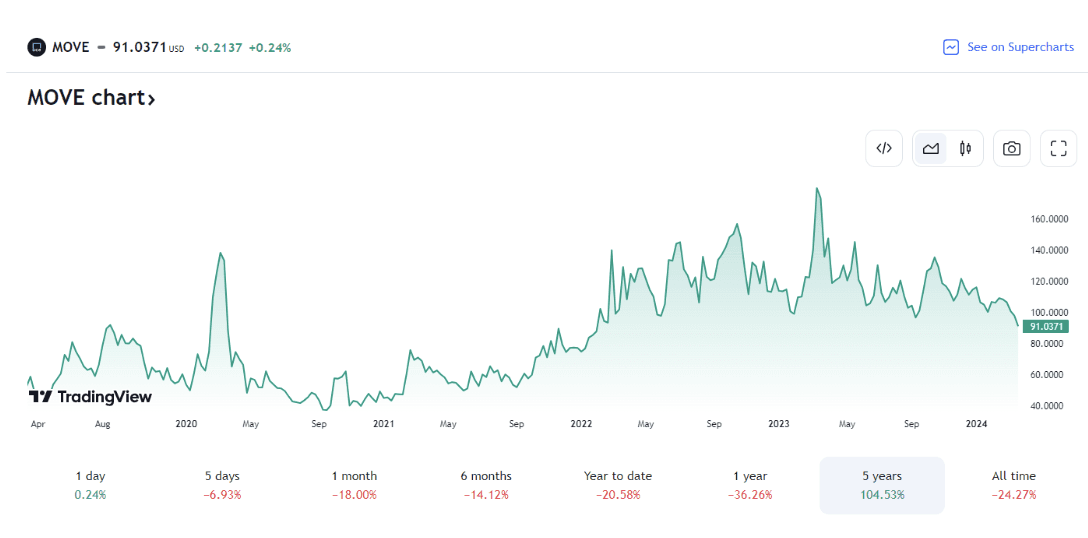

Yields Finally Calming Down

Driving this key housing market indicator lower is a fresh 26-month low in Treasury rate volatility. The ICE BofA MOVE Index (MOVE) dropped hard post-Fed last week, and if the trend persists, there could be better conditions ahead in the housing market amid the current dearth of existing homes available for sale.

It’s an important trend to monitor as increased home purchase activity, particularly among young families just starting out, has a spending cascade effect – homes must be furnished, and expensive upgrades are commonly made which can provide a boost to GDP’s consumption component.

MOVE Interest Rate Volatility Index Drops to 2-Year Lows

Source: TradingView

It’s About Time: LEI Turns Positive

Lastly, kudos to The Conference Board’s Leading Economic Index (LEI). After 23 long months in the red, the diffusion index flipped positive. We say this a bit tongue-in-cheek since the LEI has not been a useful barometer of impending economic decline recently. Much like the yield-curve inversion (which, by the way, is now the longest in history), bears standing by waiting for a precipitous drop in GDP, as the LEI seemed to suggest, have missed out on the market’s rally.

It is yet another data point that while Q1’s real GDP expansion rate may turn out to be unimpressive near 2%, emerging signals point to a potential growth acceleration later this year. This comes as The Conference Board dropped its recession forecast in the same report a month ago.

LEI Prints Positive for the First Time in Nearly Two Years

Source: The Conference Board

The Bottom Line

Party on. Stocks big and small rose last week following a no-sweat Fed decision and Powell press conference. Equities look to close out one of the stronger first quarters in recent memory amid a backdrop that might not be Goldilocks, but with the FOMC now OK with a few bumps in the inflation road, the bulls remain in charge. Ahead of the Easter weekend, we must always be mindful that risks can hop to the forefront at any time, so our portfolio management team remains vigilant across the macro spectrum.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!