Updated February 5, 2024

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

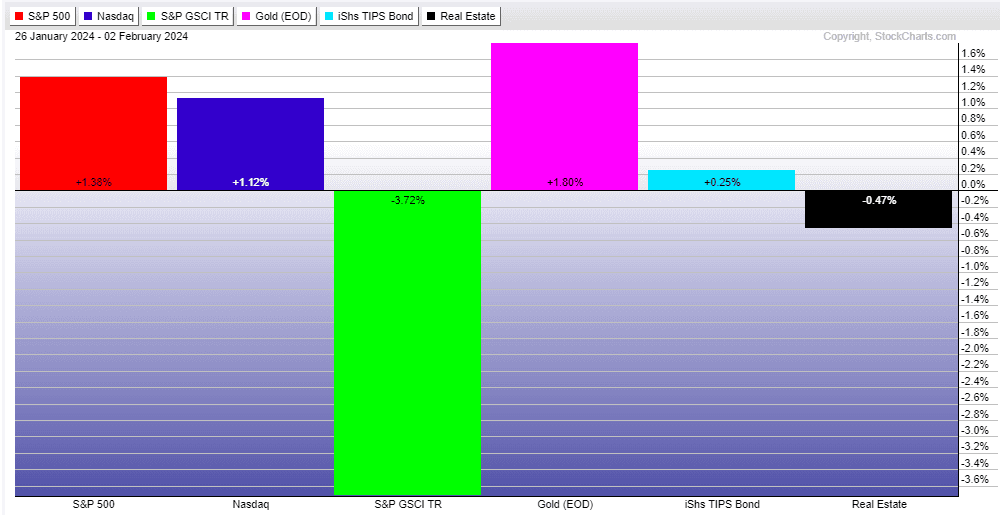

Stocks steamrolled ahead last week. The S&P 500, up 13 of the past 14 weeks, rose to a fresh record high and is knocking on the door of the psychological 5,000 mark. The Nasdaq slightly underperformed the SPX, up 1.1% during the earnings-heavy week. Sector-wise, Consumer Discretionary was the big winner, up 3.3%, on the heels of a solid quarterly earnings report from Amazon (AMZN). Meta Platforms issued blowout Q4 results which helped lift the high-momentum Communication Services sector to a two-year peak. Comm Services has jumped 10% already this year, leaving all other sectors in the dust. Energy and Real Estate were the laggards – the only two negative areas of the S&P 500.

Interest rates had a volatile week. The yield on the benchmark 10-year Treasury note finished lower by 12 basis points, but that doesn’t tell the whole story. Bonds were bid through Friday morning, but a gangbuster January jobs report sent rates soaring. The 2-year Treasury yield had its biggest one-day advance since last March on Friday. Overall, though, the TIPS ETF finished in the black while rekindled fears of regional banking turmoil helped lift gold prices higher by almost 2% last week. Oil, on the other hand, suffered its worst weekly decline in four months amid easing geopolitical tensions and a strong US Dollar Index.

For the year, the S&P 500 is up 4.0% and the Nasdaq Composite is higher by 4.1%.

Large Caps Soar to Fresh All-Time Highs Following Strong Economic Data

Source: Stockcharts.com

The Look Ahead

Our macro desk catches a bit of a breather this week. The data deck is much lighter following an onslaught of key reports in recent days. Monday, often a quiet day for economic news, features important releases from S&P Global and the Institute For Supply Management (ISM) - January Services PMI data comes out shortly after the opening bell which could be market moving as that segment of the economy has been in expansion mode, offsetting a weak manufacturing sector. Then, in the afternoon, the Federal Reserve will release its quarterly Senior Loan Officer Opinion Survey on bank lending practices. That report might take on more focus after New York Community Bancorp’s (NYCB) volatility during the middle of last week.

MBA Mortgage Applications comes out on Wednesday in the pre-market. While demand for home loans has ticked up lately, last Friday’s bond-market bludgeon could stymie mortgage activity should near-7% 30-year fixed rate mortgage levels hold. Recall that the most recent S&P Case-Shiller Home Price Index revealed a modest dip in prices for November 2023 (though they were higher from year-ago levels). Trade Balance data hits the tape later that morning which could impact the currently high Atlanta Fed GDPnow gauge which shows a 4.2% Q1 2024 real rate of expansion. A fresh read on Consumer Credit comes about Wednesday before weekly Jobless Claims, which ticked up last week, cross the wires Thursday before the bell. Wholesale Inventories and tweaks to CPI will be announced Thursday and Friday, respectively.

A Data Respite: The ISM Services Survey, Quarterly SLOOS, and CPI Revisions Are the Highlights. Fed Speak Kicks into High Gear.

Source: BofA Global Research

Earnings Reports This Week

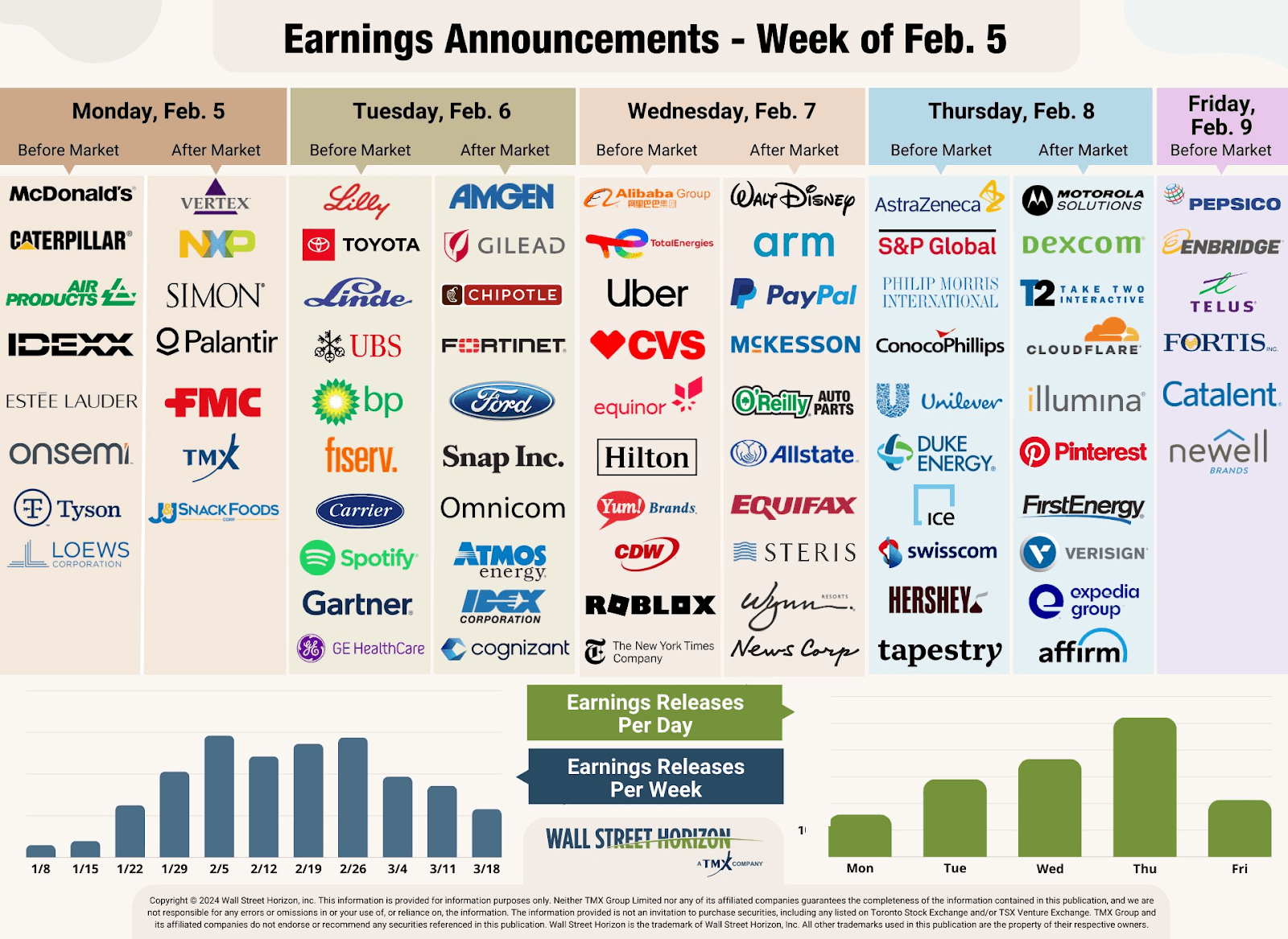

Forty-six percent of S&P 500 companies have reported Q4 results. The earnings beat rate is near the long-term average at 72% as of last Friday, according to Factset. After strong results from some of the Magnificent Seven, the Q4 blended EPS growth rate for the SPX turned positive, and a second straight quarter of YoY earnings gains appears likely.

This week, multinational blue chips snatch the spotlight from the Mag 7. McDonald’s (MCD) and Caterpillar (CAT) offer clues on the consumer and industrial activity trends Monday morning. Two hot stocks, Eli Lilly (LLY) and Toyota (TM), report in the pre-market Tuesday while Healthcare heavyweights Amgen (AMGN) and Gilead (GILD) serve up earnings that afternoon. Chipotle (CMG) hopes for a burrito blowout and Fortinet (FTNT) hopes to secure strong profits then, too.

The focus shifts overseas with numbers from Alibaba (BABA), Yum Brands (YUM), and TotalEnergies (TTE) Wednesday before the market opens, and Uber (UBER) will be closely watched at home. Walt Disney (DIS) drama will unfold after the bell while recent IPO ARM Holdings (ARM) reports. Thursday features a mix of blue-chip results, but PepsiCo's (PEP) fourth-quarter earnings and outlook may have the biggest macro implication.

Busiest Week of Global Earnings Reports: Major Companies Across Sectors and Geographies Issue Q4 Results

Source: Wall Street Horizon

Topic of the Week: Robust Data, Rethinking Rates, and Round Numbers

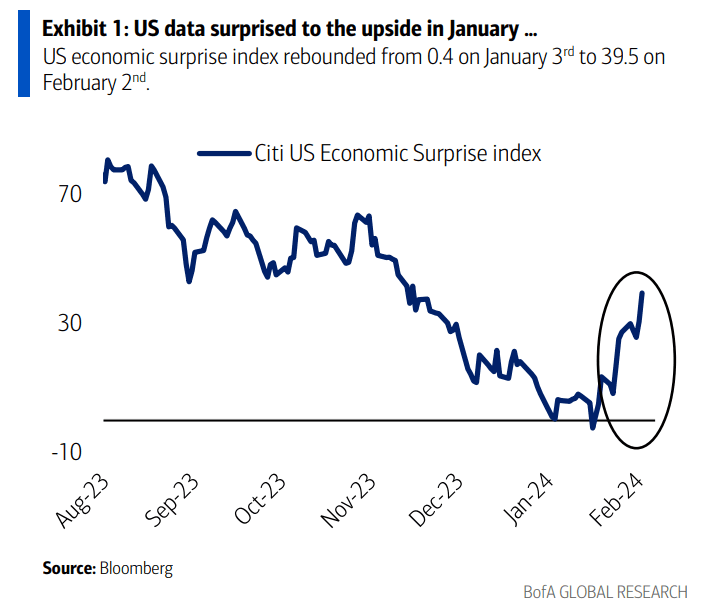

Following a lull to start the year, the Citi Economic Surprise Index has turned meaningfully higher in the last two weeks. Macro data has come in better than expected – both of the ‘hard’ and ‘soft’ varieties. Back in January, we described how vibes were on the mend among consumers across the country based on a strong University of Michigan Surveys of Consumers report. Then, last Tuesday, The Conference Board’s monthly Consumer Confidence survey revealed similarly positive feelings about the domestic economy – a fresh high since December 2021.

Citi US Economic Surprise Index Recovers After Trending Lower in Q4 2023

Source: BofA Global Research

Surprising Data

A still-healthy jobs market, cooling inflation, and lower gas prices compared to 18 months ago helped send the Present Situation Index to its highest level since before the pandemic. That's what we describe as ‘soft’ data, or mere feelings about the health of the economy. As last week pressed on, key ‘hard’ data points arrived. In general, true gauges of the state of growth suggested no imminent recession. It was actually the opposite – not only was Q4 last year a period of slightly above-trend growth, but early reads on the expansion rate to start 2024 underscore continued momentum.

Consumer Confidence Report: Households More Upbeat

Source: The Conference Board

A January Jobs Jolt

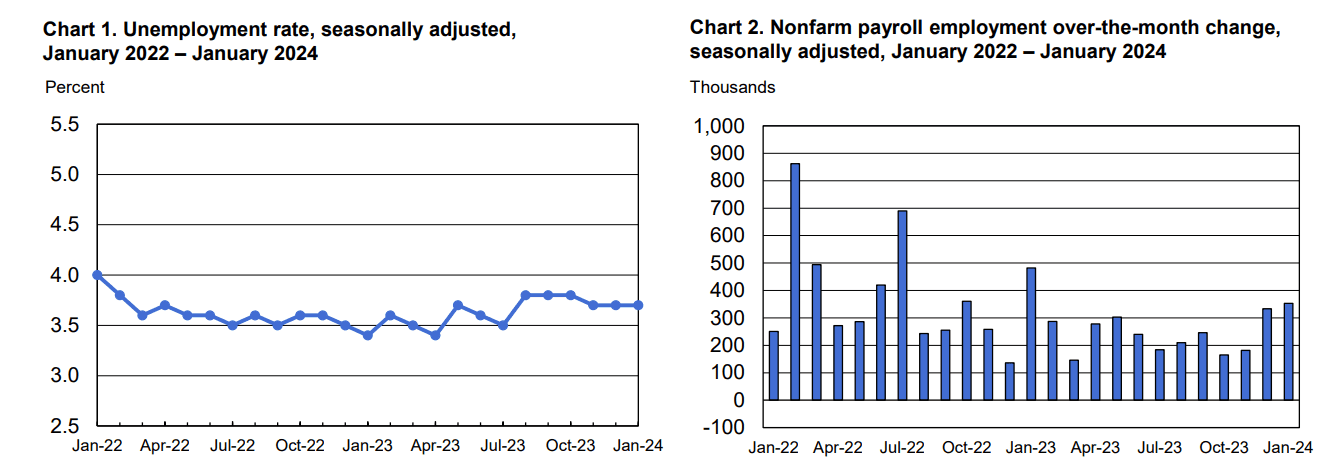

As the Economic Surprise Index climbs, forecasters may have to up their Q1 2024 GDP growth targets, particularly in light of a seemingly strong January jobs report. The most important hard data set each month, the Labor Department reported a 353,000-headline employment gain, nearly double what economists expected. That came after a solid ISM Manufacturing survey beat.

Perhaps just as surprising in the payrolls report, two-month net revisions were positive at +126,000. For much of last year, revisions were solidly in the red, suggesting the initial prints painted an overly rosy picture of the labor market. The unemployment rate held steady at 3.7% in January, not far from multi-decade lows, though the U-6 “underemployment rate” ticked up to 7.2%.

January Jobs: A Low & Steady Unemployment Rate, Nonfarm Payrolls Trending Up

Source: BLS

Interest Rates Jump After an Early-Week Decline

What rattled the markets initially, and the bond market throughout the session on Friday, was the +0.6% surge in monthly average hourly earnings. On a year-over-year basis, earnings were up 4.5%, soaring past the +4.1% consensus estimate. Combine the strong headline NFP number, positive revisions, and hot wage-gain data, and bond yields shot up across the Treasury curve.

Stocks wavered in the moments after the release, but US large caps eventually settled higher by more than 1% to cap off another week of gains. Small caps were stung by the rate climb, though, and the Russell 2000 Index ended in the red on jobs Friday. A rally in the US Dollar, now up five weeks in a row, pressured foreign stocks.

Beware of the Annual Adjustments

We would caution investors not to get too caught up in that report, though. Seasonal adjustments play an impactful role in the first employment read of the year, and post-COVID, it has become more difficult to make such tweaks. Also consider that there was a significant 0.2-hour decline in average weekly hours worked (though that metric may have been negatively impacted by bad weather last month), and the household survey, used to determine the unemployment rate, showed a small decline in employment.

Impacts to Future Interest Rates

Still, the markets spoke. On the back of the hot data, bond traders pushed out expectations for the first interest rate cut from March to May. Earlier in the week, there were no major surprises in the Fed’s statement and decision to leave interest rates unchanged. Chair Powell suggested that the Committee was unlikely to ease its policy rate at the March meeting, but price action in the Fed Funds futures market was maybe not what you’d expect.

Going into Tuesday’s two-day Fed gathering, there was about a 50/50 chance of the first quarter-point cut coming in March. After Powell spoke, the odds dipped to just 20%. Then, however, more jitters around NYCB resulted in an increased probability of a March ease. Even after Friday’s hot headline jobs gain, there remains about a 1-in-3 chance of a cut at the March 20 FOMC event. While stronger-than-expected economic data and a better mood among consumers have prevailed, the ‘higher for longer’ narrative is by no means a slam dunk to play out.

Not All Evidence Points to a Hot Employment Situation

NYCB is one cautionary situation, but we also received mixed evidence about the labor market from other reports last week. The JOLTS number was undoubtedly hawkish, but Challenger Gray job cut announcements rose, as did the weekly initial unemployment claims number. The ADP Private Payrolls report was also a bit light.

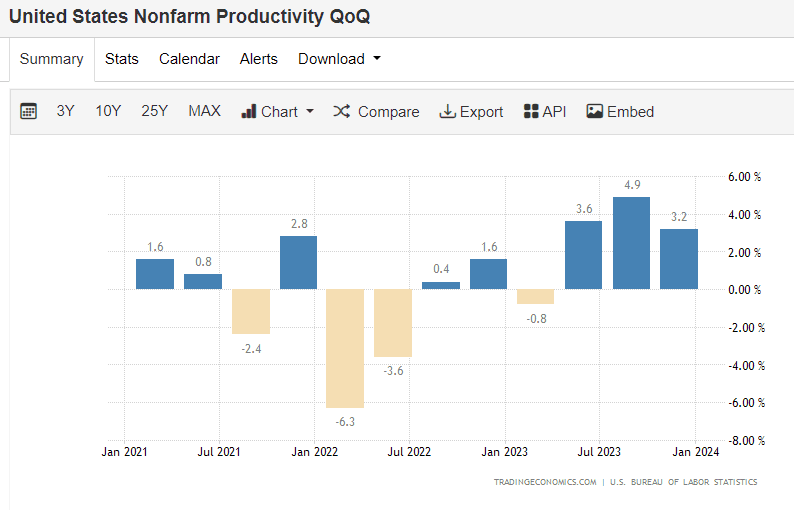

The Labor Productivity Boost Persists

On the inflation side of the ledger, Wednesday’s Employment Cost Index for the fourth quarter verified to the cool side. That’s a potentially big deal as it signals that employers are squeezing more work out of their employees versus what they are paying out. The Q4 Unit Labor Cost number, which was released last Thursday, came in sharply under forecasts, helping to send Nonfarm Productivity to +3.2% - a third consecutive healthy print following a weak productivity period during and just after the pandemic when workers were hopping from one job to another.

Three Straight Quarters of Improved Productivity

Source: Trading Economics

Hawks Versus Doves

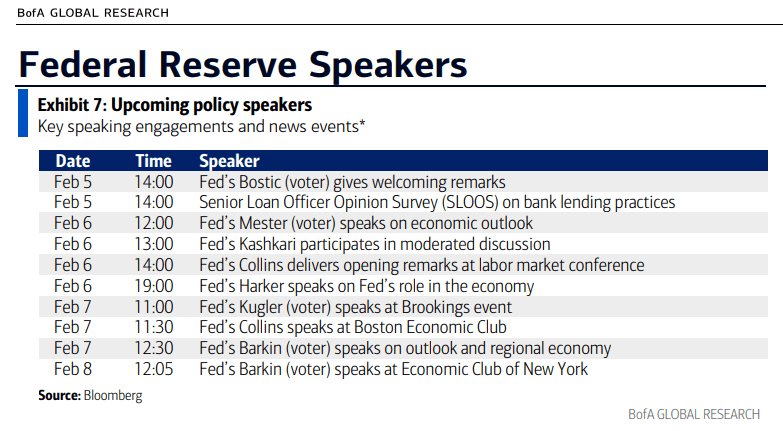

The rates market remains a battle between stout growth data and sanguine inflation reports. The hawks ask, “Why cut rates now? Growth is strong.” The doves argue, “Real-time inflation measures are already at, or even below, the Fed’s 2% target.” We will find out more from FOMC members this week amid a flurry of Fed Speak Monday afternoon through midday Thursday; the bond market will be all ears.

Upcoming Fed Speaking Engagements

Source: BofA Global Research

Market Impact

It was a powerhouse week of data and corporate earnings. All told, the S&P 500 is now within spitting distance of the potentially psychologically important 5,000 mark while the 10-year note yield hovers near 4%. These round numbers can play tricks with investors. As we venture into a sometimes-dicey stretch on the calendar from mid-February through mid-March, and as the SPX is already close to the average strategist's year-end target, a pause would make sense. The Russell 2000, meanwhile, continues to have fits around its significant round number, fittingly 2000.

The other figure we’ll be watching is zero. A 0% EPS growth rate could still be in the cards if the back half of earnings season is not up to snuff. In fact, excluding the Mag 7, EPS growth on the S&P 500 would be down over 8%, according to Factset. But with a positive first month in the book, the vaunted January stock market barometer asserts more 2024 gains ahead.

The Bottom Line

Last week’s bevy of data, the Fed meeting, and a slew of solid large-cap earnings helped send the S&P 500 to fresh highs. Amid solid growth indicators and more inflation readings that the Fed wants to see, economists debate whether the first rate cut will come in March, May, or June. Fed Speak and a broadening out of Q4 earnings reports are the highlights this week as the bullish train keeps chugging along.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!