Updated December 11, 2023

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Recap

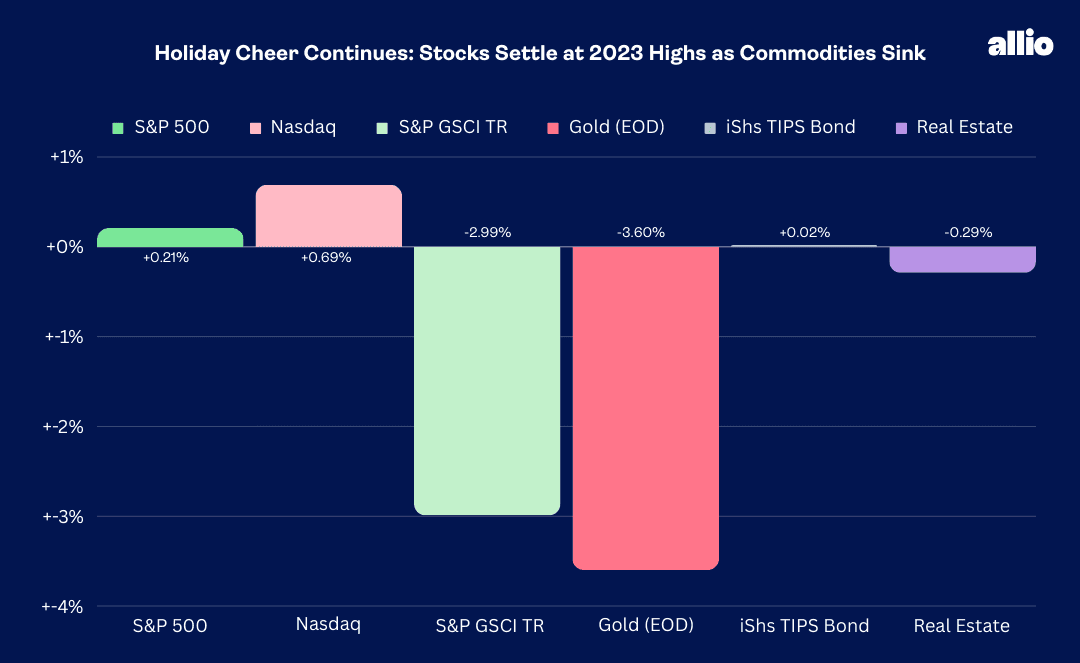

Stocks rose for a sixth straight week. The S&P 500’s 0.2% advance was nothing to write home about, and it continues the non-dramatic grind higher following a sharp recovery off the late October lows. Both the SPX and Nasdaq Composite notched fresh closing highs going back to March 2022. Mega-cap tech led the way with solid gains from five of the Magnificent Seven stocks, Microsoft (MSFT) and Amazon (AMZN) being the laggards. Indeed, Consumer Discretionary, Communication Services, and Information Technology were the only three sectors that outpaced the SPX, while oil’s seven-week losing streak resulted in Energy being the weakest slice of the market. Small caps were higher too while foreign stocks ended slightly down.

The bond market stretched its rally further, with the 10-year Treasury rate ticking down to 4.1% for a time before Friday’s solid jobs report sent yields higher. Bonds, including TIPS, finished about unchanged for the week while the rate-sensitive Real Estate sector lost modest ground. The week began with volatility in the gold market – record-high prices were seen on Sunday the 3rd but gold bears overwhelmed the gold bugs, resulting in a rather ugly week for the precious metal. The oil market felt similar selling pressure – WTI traded into the $60s, the lowest since June, last Thursday before a Friday bounce.

For the year, the S&P 500 is up 19.9% and the Nasdaq is higher by 37.6%.

December 1, 2023 - December 8, 2023

The Look Ahead

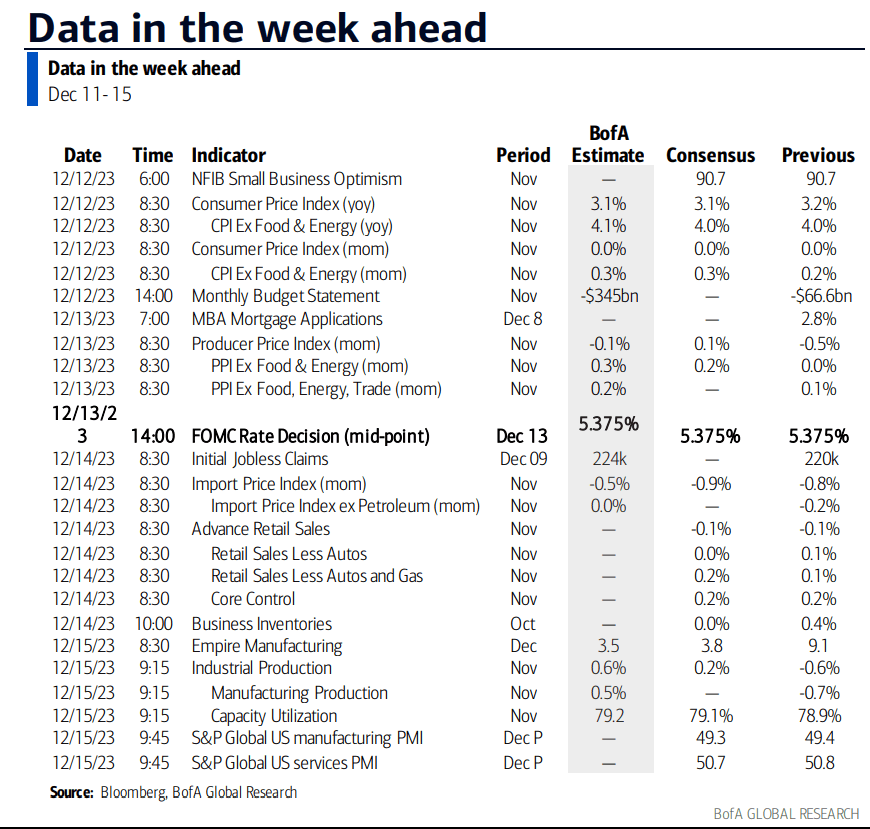

It’s another jam-packed week of data and macro events that could spark volatility. Monday is light, and there will be a lack of FedSpeak given the FOMC rate decision on Wednesday. Before that, a check on small business optimism comes before the bell on Tuesday – the NFIB’s monthly survey has been exceptionally soft since the start of last year, but this will be an interesting read given last Friday’s surprising turn positive in the University of Michigan’s Consumer Sentiment Survey.

The real action comes later that morning with November CPI hitting the tape – economists expect a second consecutive 0.0% headline inflation print while the core rate (ex-food and energy) is seen rising by 0.3%. Three-month annualized measures of inflation, particularly those including real-time housing and rent data, clearly point to inflation not far from the Fed’s 2% target. With the VIX under 13, there’s muted fear priced in. PPI comes Wednesday morning, and small price gains are forecast there, too.

The aforementioned Fed interest rate announcement and press conference finally comes Wednesday afternoon. Don’t expect any change in interest-rate policy, but we will pay close attention to Chair Powell’s message as well as the FOMC’s summary of economic projections. As it stands, traders have priced in almost exactly four quarter-point cuts in 2024, but that is modestly tighter compared with what was expected before the November jobs report.

The weekly read on initial and continuing jobless claims then hits on Thursday – economists continue to look for the breadcrumbs of looming recession from those data, but there are increasing signs that the labor market is stabilizing after a Q3 slowdown. The ECB and Bank of England hold policy meetings on Thursday, as well.

On the demand front, last month’s Retail Sales report should show a decent pace of spending. Of course, record Black Friday through Cyber Monday spending may have let the cat out of the bag in terms of how willing folks are to spend even with a softening jobs situation.

The week wraps up with key data points, including the NY Empire State Manufacturing Index, November Industrial Production, and a preliminary look at December Manufacturing and Services PMIs. Friday is also triple witching in the options market, so we could see a late-week volatility jump as institutional traders square up positions.

This Week's Data Deck: The Focus Will Be on CPI, the FOMC Rate decision, and Retail Sales

Source: BofA Global Research

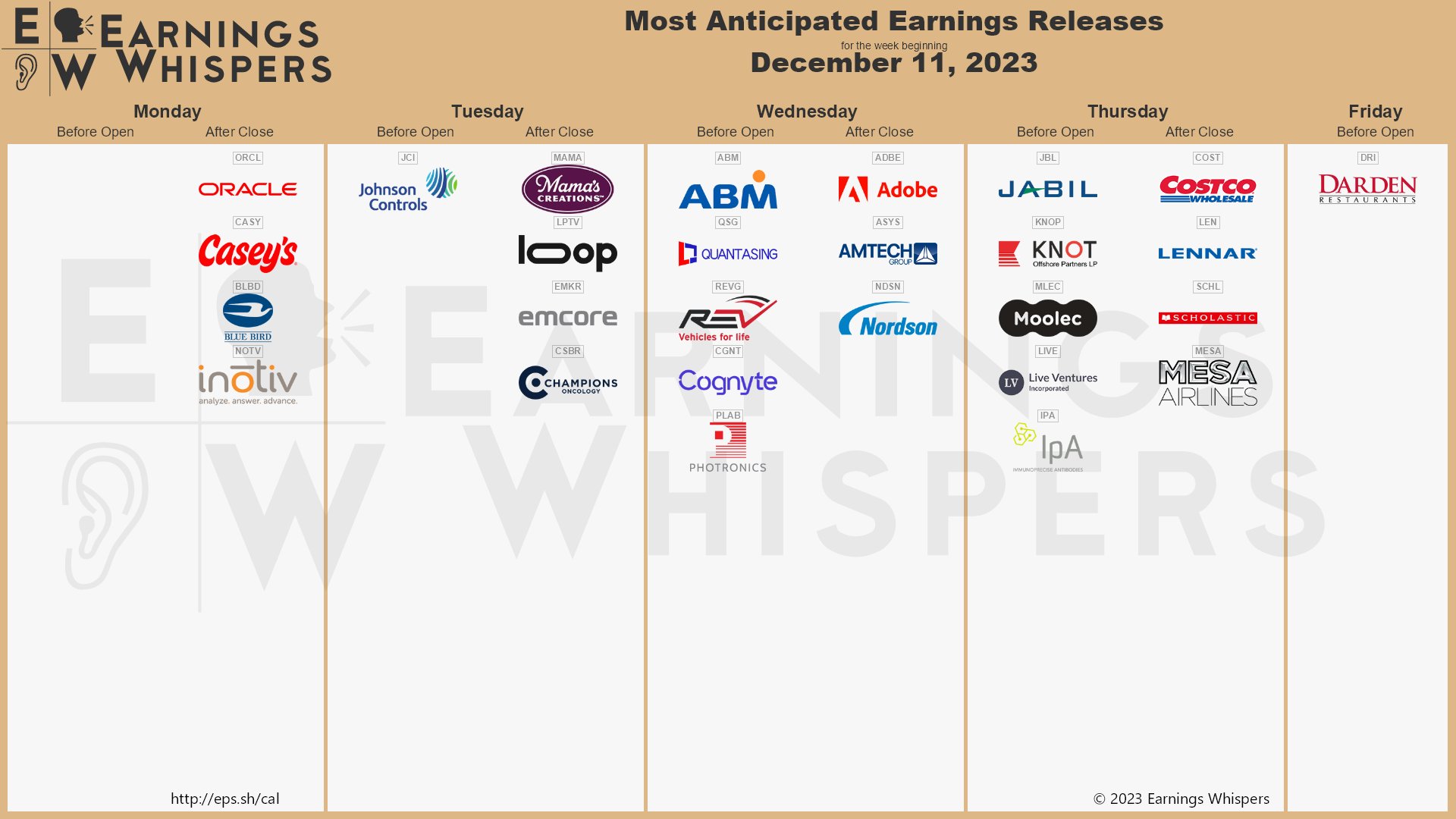

Earnings Reports This Week

The slate of Q3 reporters is light. Oracle (ORCL) and Adobe (ADBE) will be key tech sector looks before a few consumer names issue results late in the week. Keep your eye on Costco (COST) in particular – it issued a healthy November same-store sales tally, and if there is ever a company with a beat on the middle-to-high-end consumer, it’s this wholesale club.

Oracle, Adobe, Costco, Lennar, and Darden Restaurants Are the Headliners

Source: Earnings Whisper

Topic of the Week: Normalizing

Goldilocks, immaculate disinflation, the golden path. Call it what you might, but the Fed is getting its Christmas wish via moderating inflation amid an even-keel labor market expansion. Last Friday, the Labor Department reported a ho-hum 199k nonfarm payrolls gain, slightly beating the +185k consensus estimate. We can dissect and critique November’s employment addition, such as about 47k workers returning from being on strike in October and a sizable chunk of the total gain stemming from the government and Health Care sector. Markets interpreted it as a positive, though, and stocks rallied to close out a rather quiet week on Wall Street.

Unemployment Rate Dips, Monthly Job Gains Steadies near +200k

Source: BLS

Workers Re-Enter the Labor Market

The unemployment rate ticked down to 3.7% from 3.9% as a result of a very strong household survey. For background, the establishment survey is used to determine the net payrolls gain while the household survey is used to figure the unemployment rate. The latter tends to be highly volatile – it tallied 747k jobs added in November compared to a 348k fall in positions in October. More people entered the labor force last month, which is usually viewed as a positive sign as it indicates that there’s growing optimism that formerly discouraged workers can now find employment. On the flip side, a higher cost of living may prompt people to find additional work. Another positive data point was a 0.2ppt drop in the U-6 “underemployment” rate from 7.2% to 7.0%.

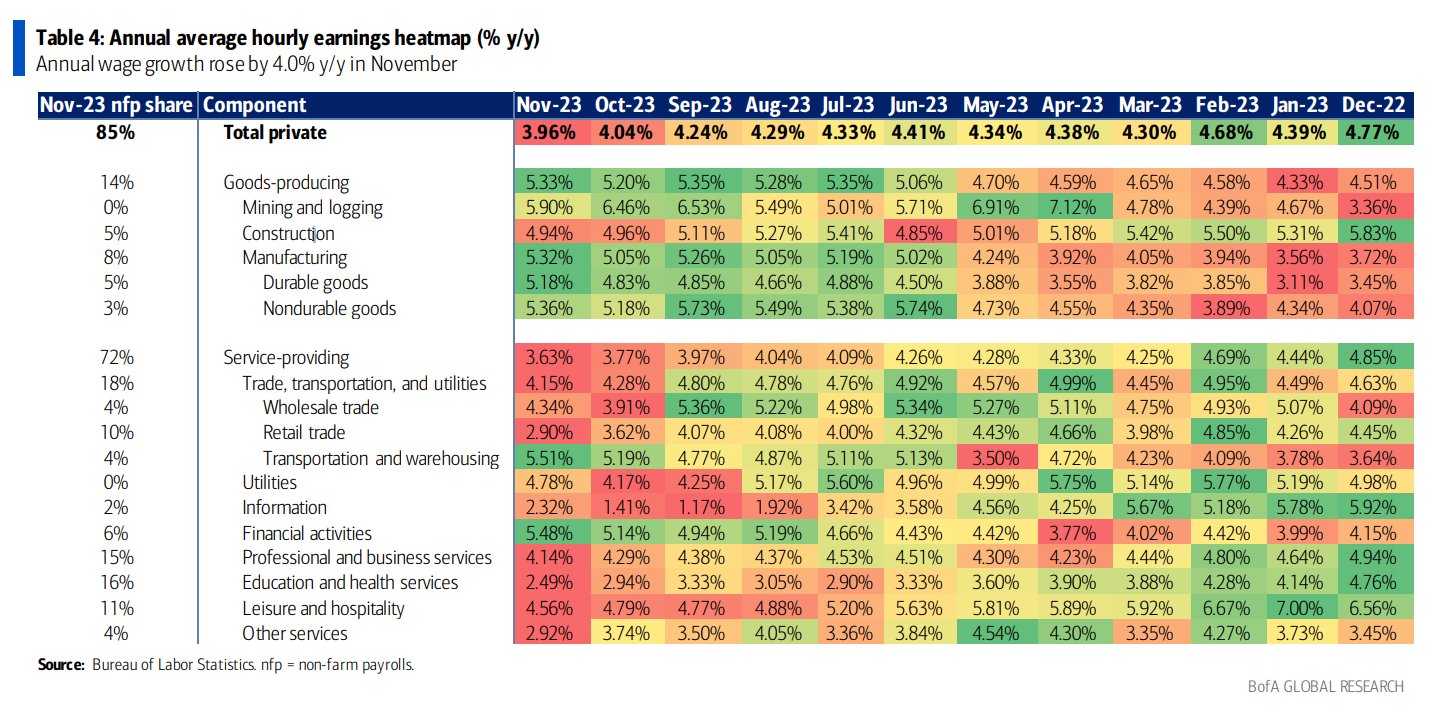

Wage Growth Ticks Lower in November

On the inflation watch, average hourly earnings continues to normalize. November’s month-over-month 0.4% climb (0.35% unrounded) was a touch hotter than economists were expecting, but the year-on-year increase of 3.96% was perhaps a few basis points to the cool side. Average weekly hours worked was stronger compared to the consensus forecast, but the gist of it all was that there is no apparent wage-price spiral ongoing that so many pundits had feared this time a year ago.

Average Hourly Earnings Cools Further, Dropping Under +4% in November

Source: BofA Global Research

Other Data Points to a Loosening Employment Situation, But Still Healthy

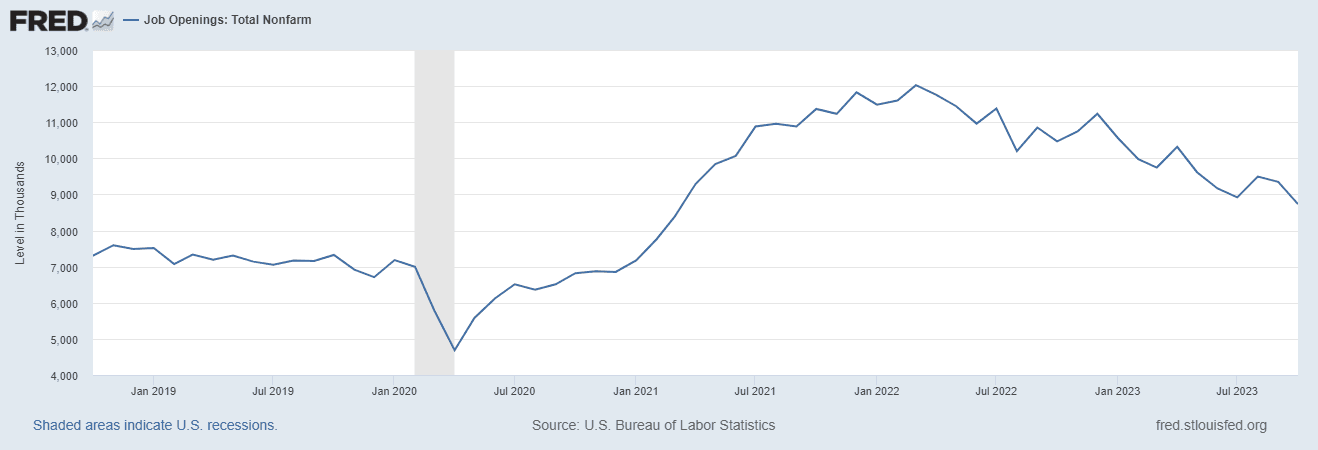

Stepping back, the labor market data for November was generally tame. Consider that the soft data from the ISM Manufacturing PMI report showed a softening in its Employment subindex - 45.8 for Manufacturing, a four-month low and easily in contraction territory. The ISM Services PMI’s 50.7 employment gauge ticked up from October’s 50.2 but remains under the average from Q3 (52.9). The JOLTS report was the big surprise of the week – the number of job openings plunged from 9.35 million in September to just 8.73 million in October, marking the lowest since March 2021. Importantly for the Fed, the JOLTS Quits Rate was unchanged at 2.3.

Job Openings Tumble to 8.73 Million

Source: St. Louis Federal Reserve

Private Sector Job Growth, Improved Productivity

Then on Wednesday last week, the ADP Employment report showed a steadying of the private sector jobs picture. The +103k print was on par with what was seen in September and October. While often a poor predictor of what the official BLS nonfarm payrolls report shows, there’s now congruency between the two in terms of a flat-lining of labor market expansion as we close out the year.

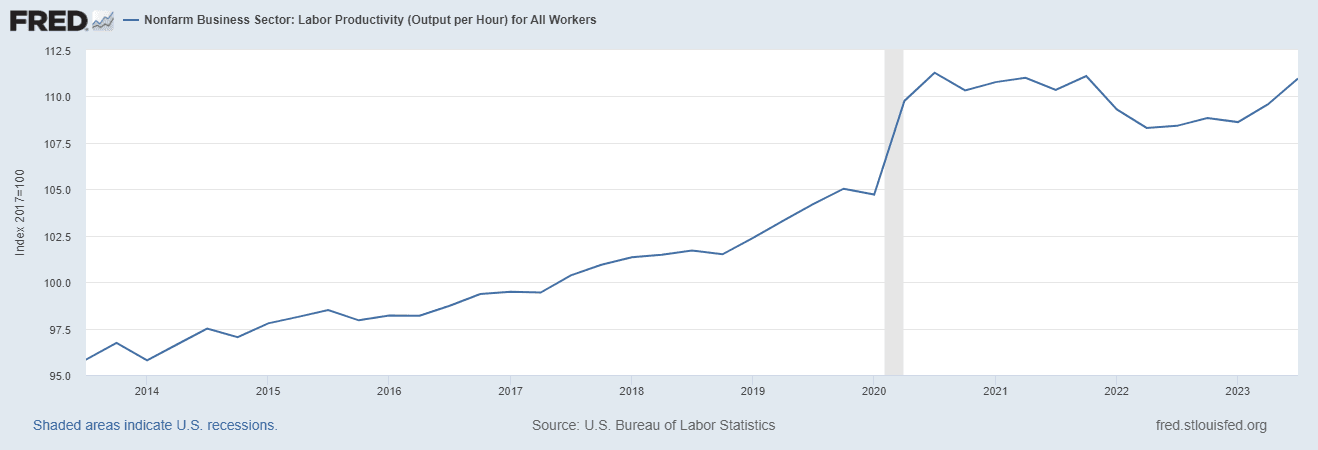

Four percent wage growth and call it +200k monthly jobs added is usually not conducive to quickly taming high inflation. There’s more to the story, though. Also released last Wednesday was the final look at Q3 nonfarm productivity and unit labor costs. Productivity for the previous quarter was revised higher from 4.9% to 5.2% while the net cost of labor (when factoring in how much work is actually getting done) is down compared to Q2 and flat versus the first quarter. The upshot is that the economy’s inflation can indeed cool to 2% even with 4% wage growth – so long as productivity keeps increasing. Maybe we can thank AI for that, or perhaps it’s a bit of workers’ collective fear of losing their jobs should a recession strike next year.

Productivity Jumps for a Second Straight Quarter

Source: St. Louis Federal Reserve

Households More Upbeat, Lower Gas Prices Help

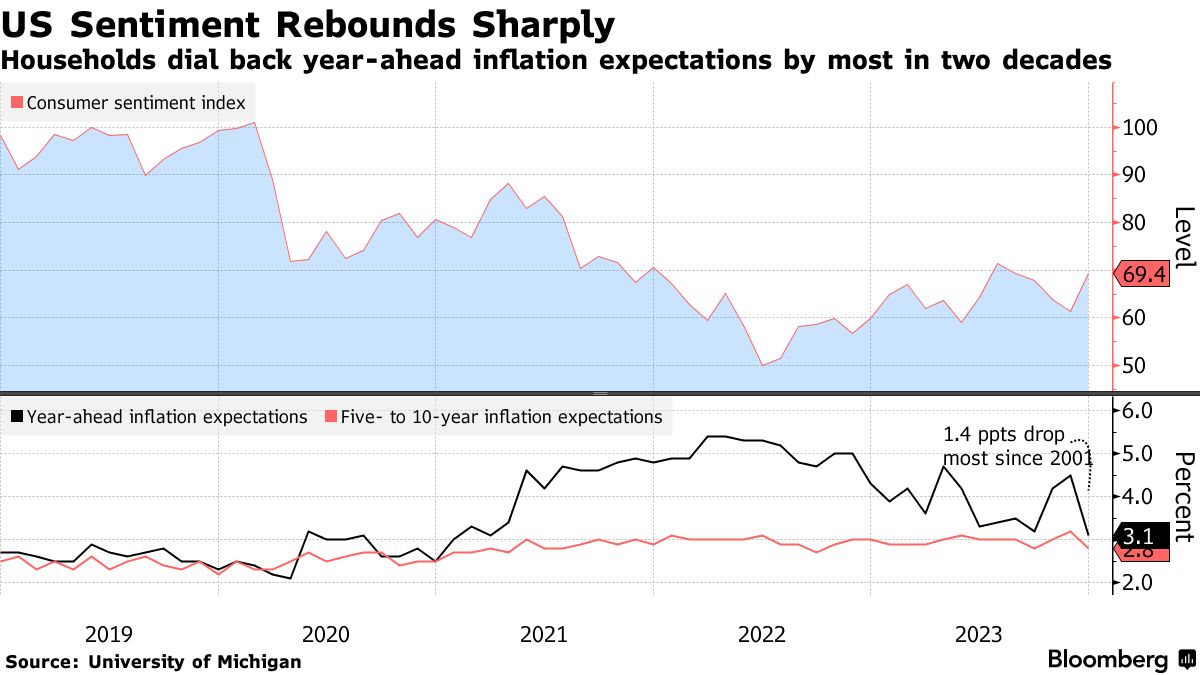

But, as hinted at earlier, there are few signs of an imminent recession (sans the Leading Economic Index and the inverted yield curve). Initial jobless claims came in right at expectations last week and, more eyebrow-raising, continuing claims fell hard, reversing the prior week’s spike. More good news was seen after the NFP report on Friday via the University of Michigan’s Consumer Sentiment survey. The 69.4 figure was a massive increase from October’s 61.3, tying the biggest sequential climb since dating back to late 2006. Sentiment remains under levels from July and August, however.

Inflation Expectations Plunge in December’s University of Michigan Consumer Survey

Source: Bloomberg

Why are consumers feeling more jolly? It’s not due to the holidays (as the survey shows little seasonal bias), but the realization of less pain at the pump. The price of a gallon of regular is fast approaching the $3 mark after peaking a few cents above $5 in June 2022. It was nearly $4 as recently as September. Not surprisingly, 1-year inflation expectations (something the Fed closely monitors) improved notably from +4.5% in November to just +3.1% in December’s preliminary look. Five-year feelings on inflation also cooled from +3.2% to +2.8%. November’s decent payrolls report and sanguine UMich survey were good enough to send stocks to fresh year-to-date highs to close the week.

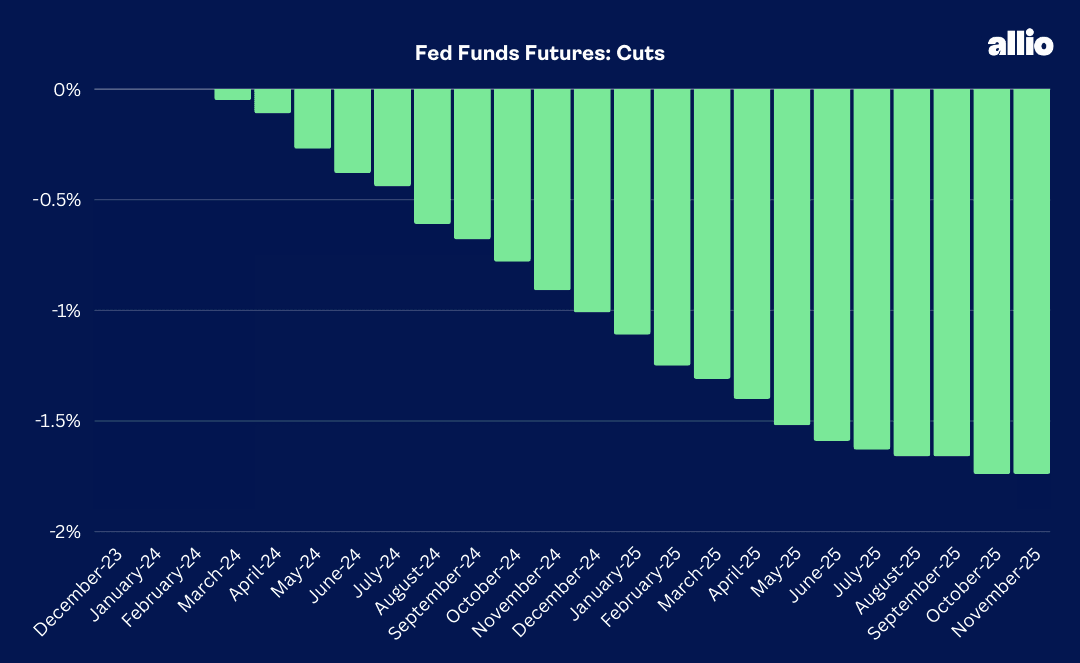

Market Impact: Less Easing Expected

There was one important change that took place in the wake of Friday’s important macro data: the Fed Funds rate outlook. Almost a full quarter-point rate cut was taken off the table for 2024 given the refreshed look at the state of the economy. Recall last week we noted that up to five rate eases were priced into 2024. With no sign of an immediately slowing economy, just 101 basis points (about four cuts) are expected, per the bond futures market, as of the end of last week. Of course, the Fed Funds futures market has a degree of ‘crash risk’ baked in – so long as an economic calamity does not take place, we should expect less easing compared to what the CME FedWatch Tool shows.

101bps of Cuts Expected Through 2024

Source: Allio Finance, CME

If it seems like a busy stretch of economic reports, you’re on point. Due to quirky timing requirements, the November jobs report was issued on the second Friday of this month, so major updates on the economy are compressed into a handful of sessions. Adding to the complexity of it all is that the Fed members must submit their dot plot forecasts before Tuesday’s CPI report. We will keep that in mind as we parse the FOMC’s collective forecast and Powell’s press conference on Wednesday afternoon.

The Bottom Line

There was a lot of data to digest last week, and the onslaught continues this week with CPI, the Fed meeting, and Retail Sales on tap. The labor market continues to settle into a comfortable expansion rate while inflation barometers generally point to more disinflation. Fewer rate cuts are expected given the November NFP picture, and we’ll get more key 2024 clues this week.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!