unlock the power of personalized macro investing

Allio gives strategic investors the tools to thrive in evolving markets.

Allio gives strategic investors the tools to thrive in evolving markets.

coming soon

unlock the power of personalized macro investing

Allio gives strategic investors the tools to thrive in evolving markets.

coming soon

coming soon

coming soon

We're not just another investing app; we're your personalized global macro investing partner, designed for the new generation of investors.

With Allio’s Dynamic Macro Portfolios, choose from an expert-curated selection of over 4,700 stocks and ETFs, spanning sectors, industries, and strategies.

Enjoy unrivaled personalization with fractional shares, real-time price execution, and robust TradingView™ technical analysis.

Allio manages your custom portfolio, reinvesting dividends and automatically rebalancing your portfolio to keep it aligned with your investment goals.

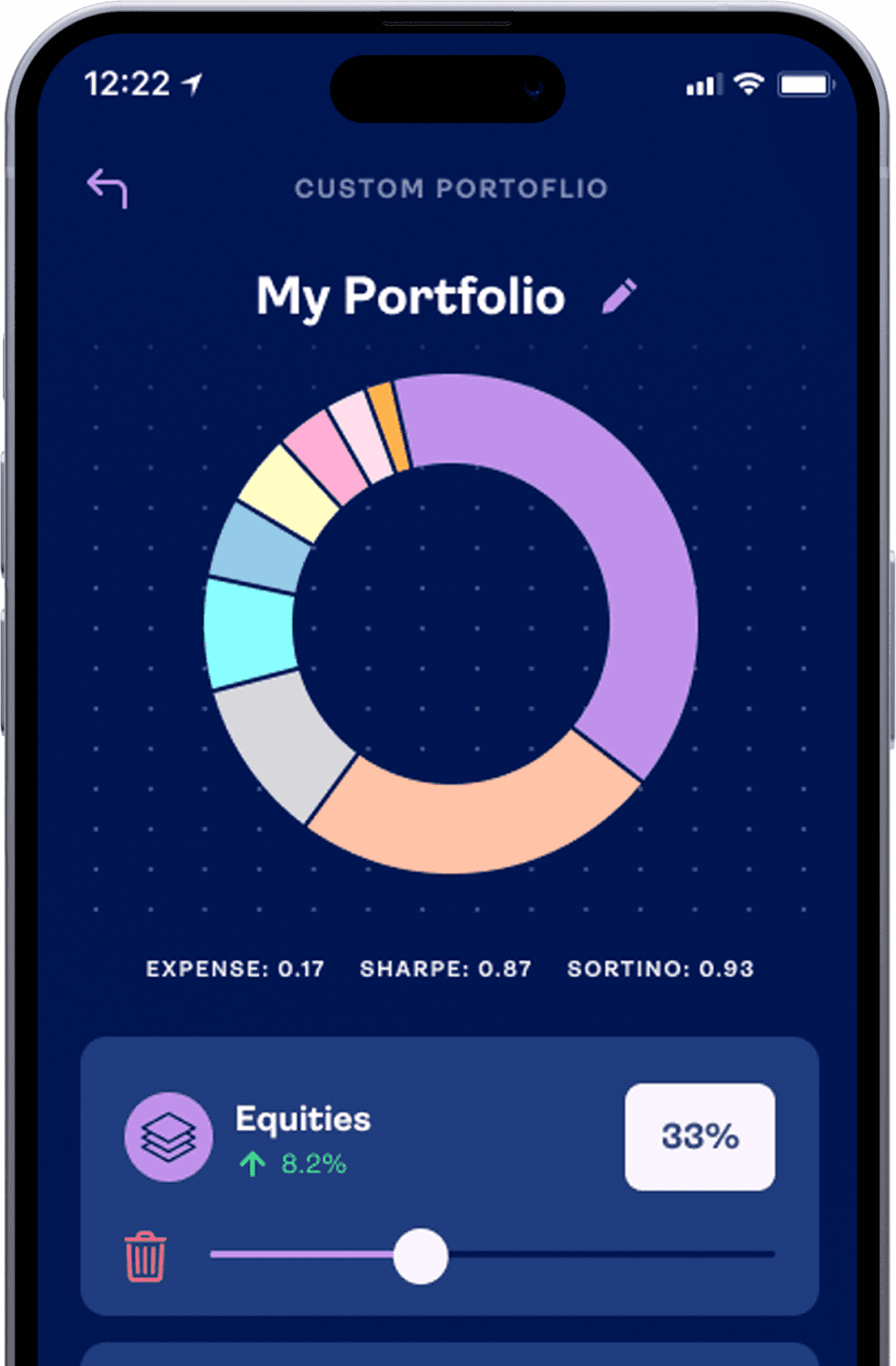

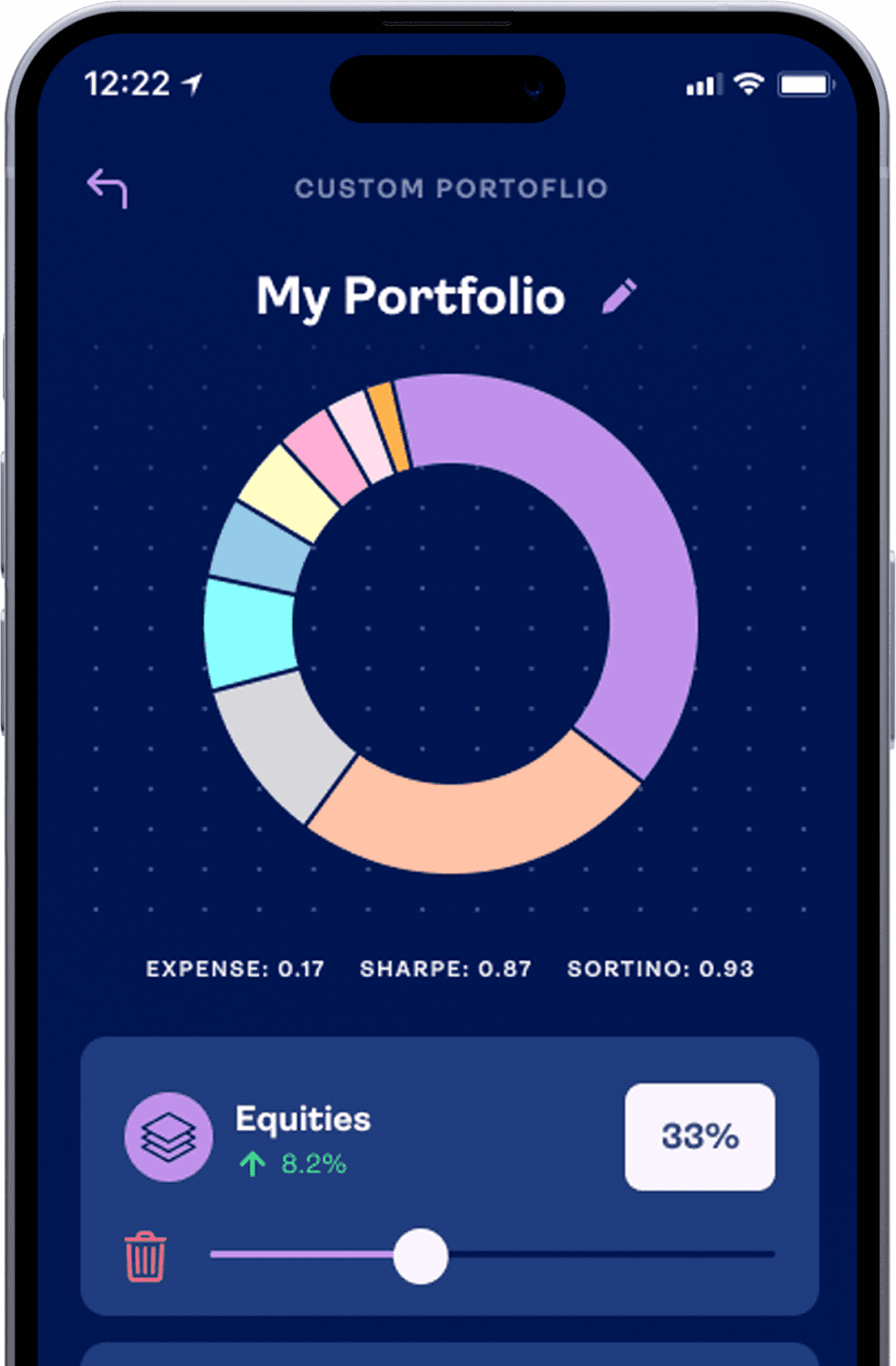

Further personalize your portfolio by easily adjusting allocations.

Allio’s completely customizable investing experience includes:

Sectors: Consumer Staples, Technology, Industrials, and more

Industries: Aerospace & Defense, Precious Metal Miners, Cannabis

Strategies: Value, Momentum, Quality, Small Cap, and more

Stocks: Choose from thousands of individual stocks to add to your portfolio with fractional shares available.

see how

Further personalize your portfolio by easily adjusting allocations.

Further personalize your portfolio by easily adjusting allocations.

Further personalize your portfolio by easily adjusting allocations.

see how

see how

see how

Allio has created a completely customizable investing experience with over 4,700 stocks and ETFs available. Choose to invest in:

Allio’s completely customizable investing experience includes:

Allio’s completely customizable investing experience includes:

Sectors: Consumer Staples, Technology, and Industrials

Sectors: Consumer Staples, Technology, Industrials, and more

Sectors: Consumer Staples, Technology, Industrials, and more

Industries: Aerospace & Defence, Precious Metal Miners, Cannabis

Industries: Aerospace & Defense, Precious Metal Miners, Cannabis

Industries: Aerospace & Defense, Precious Metal Miners, Cannabis

Strategies: Value, Momentum, Quality, Small Cap

Strategies: Value, Momentum, Quality, Small Cap, and more

Strategies: Value, Momentum, Quality, Small Cap, and more

Stocks: Choose from thousands of individual stocks to add to your portfolio with fractional shares available.

FAQs

Does Allio limit how much of my portfolio can be customized?

Unlike some companies, Allio understands that our clients want a truly personalized experience. In order to create an optimal portfolio, our clients can choose to add between 5 and 15 securities to their Dynamic Macro Portfolios.

What is the minimum amount I need to invest to get started?

Allio has a low minimum of just $50 to start investing.

How does Allio manage my Dynamic Macro Portfolio?

After you personalize your Dynamic Macro Portfolio, Allio handles the rest — reinvesting dividends and automatically rebalancing your portfolio to keep it aligned with your investment goals.

Allio’s rebalancer technology keeps track of your portfolio and positions and automatically executes buy and sell orders to keep you aligned with your positional targets and risk tolerance. Allio’s proprietary risk management technology makes sure your portfolio is properly positioned for the current macro environment.

Allio

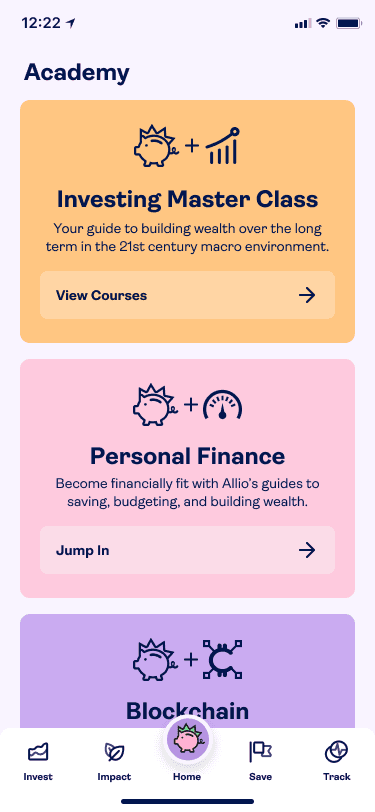

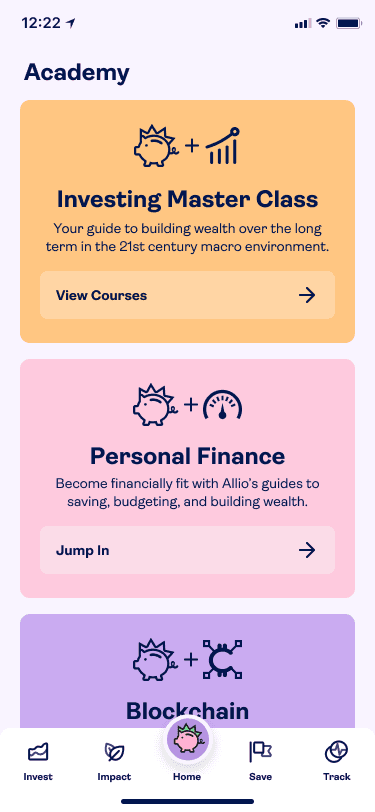

Academy

We believe in financial wellness for all,

which is why, here at Allio, we emphasize financial literacy.

Dive into some of our Allio Academy content to help you become a more informed investor.

What We Do

What We Say

Who We Are

Legal

Allio Advisors LLC ("Allio") is an SEC registered investment advisor. By using this website, you accept our Terms of Service and our Privacy Policy. Allio's investment advisory services are available only to residents of the United States. Nothing on this website should be considered an offer, recommendation, solicitation of an offer, or advice to buy or sell any security. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Additionally, Allio does not provide tax advice and investors are encouraged to consult with their tax advisor. By law, we must provide investment advice that is in the best interest of our client. Please refer to Allio's ADV Part 2A Brochure for important additional information. Please see our Customer Relationship Summary.

Online trading has inherent risk due to system response, execution price, speed, liquidity, market data and access times that may vary due to market conditions, system performance, market volatility, size and type of order and other factors. An investor should understand these and additional risks before trading. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Past performance is no guarantee of future results.

Brokerage services will be provided to Allio clients through Allio Markets LLC, ("Allio Markets") SEC-registered broker-dealer and member FINRA/SIPC . Securities in your account protected up to $500,000. For details, please see www.sipc.org. Allio Advisors LLC and Allio Markets LLC are separate but affiliated companies. Allio Capital does not offer services to Florida.

Securities products are: Not FDIC insured · Not bank guaranteed · May lose value

Any investment , trade-related or brokerage questions shall be communicated to support@alliocapital.com

Please read Important Legal Disclosures

v1 01.20.2025

What We Do

What We Say

Who We Are

Legal

Allio Advisors LLC ("Allio") is an SEC registered investment advisor. By using this website, you accept our Terms of Service and our Privacy Policy. Allio's investment advisory services are available only to residents of the United States. Nothing on this website should be considered an offer, recommendation, solicitation of an offer, or advice to buy or sell any security. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Additionally, Allio does not provide tax advice and investors are encouraged to consult with their tax advisor. By law, we must provide investment advice that is in the best interest of our client. Please refer to Allio's ADV Part 2A Brochure for important additional information. Please see our Customer Relationship Summary.

Online trading has inherent risk due to system response, execution price, speed, liquidity, market data and access times that may vary due to market conditions, system performance, market volatility, size and type of order and other factors. An investor should understand these and additional risks before trading. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Past performance is no guarantee of future results.

Brokerage services will be provided to Allio clients through Allio Markets LLC, ("Allio Markets") SEC-registered broker-dealer and member FINRA/SIPC . Securities in your account protected up to $500,000. For details, please see www.sipc.org. Allio Advisors LLC and Allio Markets LLC are separate but affiliated companies. Allio Capital does not offer services to Florida.

Securities products are: Not FDIC insured · Not bank guaranteed · May lose value

Any investment , trade-related or brokerage questions shall be communicated to support@alliocapital.com

Please read Important Legal Disclosures

v1 01.20.2025

What We Do

What We Say

Who We Are

Legal

Allio Advisors LLC ("Allio") is an SEC registered investment advisor. By using this website, you accept our Terms of Service and our Privacy Policy. Allio's investment advisory services are available only to residents of the United States. Nothing on this website should be considered an offer, recommendation, solicitation of an offer, or advice to buy or sell any security. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Additionally, Allio does not provide tax advice and investors are encouraged to consult with their tax advisor. By law, we must provide investment advice that is in the best interest of our client. Please refer to Allio's ADV Part 2A Brochure for important additional information. Please see our Customer Relationship Summary.

Online trading has inherent risk due to system response, execution price, speed, liquidity, market data and access times that may vary due to market conditions, system performance, market volatility, size and type of order and other factors. An investor should understand these and additional risks before trading. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Past performance is no guarantee of future results.

Brokerage services will be provided to Allio clients through Allio Markets LLC, ("Allio Markets") SEC-registered broker-dealer and member FINRA/SIPC . Securities in your account protected up to $500,000. For details, please see www.sipc.org. Allio Advisors LLC and Allio Markets LLC are separate but affiliated companies. Allio Capital does not offer services to Florida.

Securities products are: Not FDIC insured · Not bank guaranteed · May lose value

Any investment , trade-related or brokerage questions shall be communicated to support@alliocapital.com

Please read Important Legal Disclosures

v1 01.20.2025

What We Do

What We Say

Who We Are

Legal

Allio Advisors LLC ("Allio") is an SEC registered investment advisor. By using this website, you accept our Terms of Use and our Privacy Policy. Allio's investment advisory services are available only to residents of the United States. Nothing on this website should be considered an offer, recommendation, solicitation of an offer, or advice to buy or sell any security. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Additionally, Allio does not provide tax advice and investors are encouraged to consult with their tax advisor. By law, we must provide investment advice that is in the best interest of our client. Please refer to Allio's ADV Part 2A Brochure for important additional information. Please see our Customer Relationship Summary.

Online trading has inherent risk due to system response, execution price, speed, liquidity, market data and access times that may vary due to market conditions, system performance, market volatility, size and type of order and other factors. An investor should understand these and additional risks before trading. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Past performance is no guarantee of future results.

Brokerage services will be provided to Allio clients through Allio Markets LLC, ("Allio Markets") SEC-registered broker-dealer and member FINRA/SIPC . Securities in your account protected up to $500,000. For details, please see www.sipc.org. Allio Advisors LLC and Allio Markets LLC are separate but affiliated companies.

Securities products are: Not FDIC insured · Not bank guaranteed · May lose value

Any investment , trade-related or brokerage questions shall be communicated to support@alliocapital.com

Please read Important Legal Disclosures

v1 01.20.2025

This website is operated by Allio Advisors LLC, an SEC-registered investment adviser.

Important Disclosures: Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Please consider, among other important factors, your investment objectives, risk tolerance and Allio pricing before investing. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. It is not possible to invest directly in an index. Any hypothetical performance shown is for illustrative purposes only. Such results do not represent actual results and do not take into consideration economic or market factors which can impact performance. Actual clients may achieve investment results materially different from the results portrayed. Please note that a properly suggested portfolio recommendation is dependent upon current and accurate financial and risk profiles. Clients who have experienced changes to their goals, financial circumstances or investment objectives, or who wish to modify their portfolio recommendation, should promptly update their information in the Allio app. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them. Allio reserves the right to restrict or revoke any and all offers at any time.

Allio does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through ETFs, which invest in Bitcoin futures. Bitcoin has historically demonstrated high volatility. Particular investment strategies should be evaluated based on an investor’s tolerance for risk.

Allio does not provide access to invest directly in gold and other commodities. This commodity exposure is provided through ETFs that invest in commodities (i.e., gold) or in commodity futures. Investing in gold and other commodities, including through ETFs that invest in commodities or in commodity futures, is considered a high-risk investment given the speculative and volatile nature.

Compounding, generally, is the growth of principal investments due to the reinvestment of dividends without withdrawing funds from the account. Allio investment accounts do not pay interest, so the impact of compounding may be limited by the number of ETF shares an investor owns, as well as the frequency and amount of dividends paid by the ETFs in an investor’s Allio investment account. Compounding is not an investing strategy. Rather, it is a potential side effect of holding certain investments that are purchased as part of an investment strategy. The potential effect of compounding in an investor’s account does not assure positive performance of the account nor does it protect against losses. It does not take into account market volatility and fluctuations that will impact the value of any investment account.

The ETFs comprising the portfolios charge fees and expenses that will reduce a client’s return. Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. Investment policies, management fees and other information can be found in the individual ETF’s prospectus. Please read the prospectus carefully before you invest.

The effectiveness of the tax-loss harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Allio and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term). Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any

Investments in securities: Not FDIC Insured • No Bank Guarantee • May Lose Value. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Allio's internet-based advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see our Form CRS, our Form ADV Part 2A, and other disclosures. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

Promotional Terms & Conditions *Allio20 sign-up bonus ($20) is exclusively for new customers who have not previously joined Allio. Offer is valid after meeting the following criteria: 1) Client must set up a new Allio account; 2) Client must fund their account with a minimum of $20; 3) Client must maintain Allio account for a minimum of 30 days. After the 30-day period concludes, the $20 sign-up bonus will be available in the Client account. Account approval is contingent on verification and approval pursuant to regulatory requirements. Allio Finance reserves the right to restrict or revoke this promotional offer at any time and without notice. All investments involve risk, including loss of principal. Investment advisory services provided by Allio Advisors LLC, an SEC-registered investment adviser.

This website is operated by Allio Advisors LLC, an SEC-registered investment adviser.

Important Disclosures: Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Please consider, among other important factors, your investment objectives, risk tolerance and Allio pricing before investing. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. It is not possible to invest directly in an index. Any hypothetical performance shown is for illustrative purposes only. Such results do not represent actual results and do not take into consideration economic or market factors which can impact performance. Actual clients may achieve investment results materially different from the results portrayed. Please note that a properly suggested portfolio recommendation is dependent upon current and accurate financial and risk profiles. Clients who have experienced changes to their goals, financial circumstances or investment objectives, or who wish to modify their portfolio recommendation, should promptly update their information in the Allio app. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them. Allio reserves the right to restrict or revoke any and all offers at any time.

Allio does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through ETFs, which invest in Bitcoin futures. Bitcoin has historically demonstrated high volatility. Particular investment strategies should be evaluated based on an investor’s tolerance for risk.

Allio does not provide access to invest directly in gold and other commodities. This commodity exposure is provided through ETFs that invest in commodities (i.e., gold) or in commodity futures. Investing in gold and other commodities, including through ETFs that invest in commodities or in commodity futures, is considered a high-risk investment given the speculative and volatile nature.

Compounding, generally, is the growth of principal investments due to the reinvestment of dividends without withdrawing funds from the account. Allio investment accounts do not pay interest, so the impact of compounding may be limited by the number of ETF shares an investor owns, as well as the frequency and amount of dividends paid by the ETFs in an investor’s Allio investment account. Compounding is not an investing strategy. Rather, it is a potential side effect of holding certain investments that are purchased as part of an investment strategy. The potential effect of compounding in an investor’s account does not assure positive performance of the account nor does it protect against losses. It does not take into account market volatility and fluctuations that will impact the value of any investment account.

The ETFs comprising the portfolios charge fees and expenses that will reduce a client’s return. Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. Investment policies, management fees and other information can be found in the individual ETF’s prospectus. Please read the prospectus carefully before you invest.

The effectiveness of the tax-loss harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Allio and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term). Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any

Investments in securities: Not FDIC Insured • No Bank Guarantee • May Lose Value. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Allio's internet-based advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see our Form CRS, our Form ADV Part 2A, and other disclosures. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

Promotional Terms & Conditions *Allio20 sign-up bonus ($20) is exclusively for new customers who have not previously joined Allio. Offer is valid after meeting the following criteria: 1) Client must set up a new Allio account; 2) Client must fund their account with a minimum of $20; 3) Client must maintain Allio account for a minimum of 30 days. After the 30-day period concludes, the $20 sign-up bonus will be available in the Client account. Account approval is contingent on verification and approval pursuant to regulatory requirements. Allio Finance reserves the right to restrict or revoke this promotional offer at any time and without notice. All investments involve risk, including loss of principal. Investment advisory services provided by Allio Advisors LLC, an SEC-registered investment adviser.

Why most Robo Advisors are Ineffective

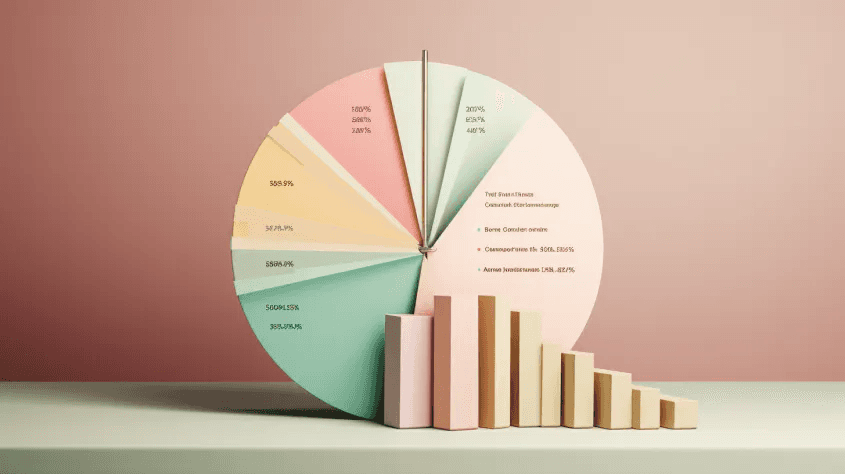

Optimize Your Portfolio with a Macro Investment Strategy

Diversification for Portfolio Optimization

Allio

Academy

Allio

Academy

Allio

Academy

We believe in financial wellness for all, which is why, here at Allio, we emphasize financial literacy.

Dive into some of our Allio Academy content to help you become a more informed investor.

We believe in financial wellness for all, which is why, here at Allio, we emphasize financial literacy.

Dive into some of our Allio Academy content to help you become a more informed investor.

We believe in financial wellness for all, which is why, here at Allio, we emphasize financial literacy.

Dive into some of our Allio Academy content to help you become a more informed investor.

FAQs

Does Allio limit how much of my portfolio can be customized?

Unlike some companies, Allio understands that our clients want a truly personalized experience. In order to create an optimal portfolio, our clients can choose to add between 5 and 15 securities to their Dynamic Macro Portfolios.

What is the minimum amount I need to invest to get started?

Allio has a low minimum of just $50 to start investing.

How does Allio manage my Dynamic Macro Portfolio?

After you personalize your Dynamic Macro Portfolio, Allio handles the rest — reinvesting dividends and automatically rebalancing your portfolio to keep it aligned with your investment goals.

Allio’s rebalancer technology keeps track of your portfolio and positions and automatically executes buy and sell orders to keep you aligned with your positional targets and risk tolerance. Allio’s proprietary risk management technology makes sure your portfolio is properly positioned for the current macro environment.

unlock the power of personalized

macro investing

Allio gives strategic investors the tools to thrive in evolving markets.

get started

unlock the power of personalized

macro investing

Allio gives strategic investors the tools to thrive in evolving markets.

get started

The first ever finance platform to combine ease of use with sophisticated wealth management is upon us. Allio's Dynamic Macro Portfolios offer an unrivaled personalized investment experience for wherever you're at in your investment journey.

We're not just another investing app; we're your personalized global macro investing partner, designed for the new generation of investors.

We're not just another investing app; we're your personalized global macro investing partner, designed for the new generation of investors.

With Allio, you have the luxury of personalizing your portfolio with the sectors, industries, strategies, and stocks of your choice. We'll take it from there—

managing your customized portfolio—keeping it rebalanced and aligned with your goals.

Whether you want to choose individual stocks or you've just heard about an upcoming sector or industry, without knowing a specific company to invest in, we've got you covered.

With Allio’s Dynamic Macro Portfolios, choose from an expert-curated selection of over 4,700 stocks and ETFs, spanning sectors, industries, and strategies.

Enjoy unrivaled personalization with fractional shares, real-time price execution, and robust TradingView™ technical analysis.

Allio manages your custom portfolio, reinvesting dividends and automatically rebalancing your portfolio to keep it aligned with your investment goals

With Allio’s Dynamic Macro Portfolios, choose from an expert-curated selection of over 4,700 stocks and ETFs, spanning sectors, industries, and strategies.

Enjoy unrivaled personalization with fractional shares, real-time price execution, and robust TradingView™ technical analysis.

Allio manages your custom portfolio, reinvesting dividends and automatically rebalancing your portfolio to keep it aligned with your investment goals

start investing